In this documentary on the history of money, banking and the monetary system, “Power To The People,” we discuss the purpose of money, where money comes from, how the banking system creates money, how fractional reserve banking works, the different types of money in use in the global economy and the basics of how money circulates in the economy. We also talk about how the boom and bust cycle fuels arguments against free market capitalism and for socialism.

We discuss the origins of fractional reserve banking and where money comes from, how government debt became the national money supply, and the history of money using wooden tally sticks, gold, silver and paper money. The history and origins of central banking, the first central bank, the bank of England, which became the model for modern banking. Hyperinflation and how it destroys the value of paper money. The first central banks of the United States. Andrew Jackson and his fight against central banking and corrupt bankers. Abraham Lincoln’s use of non-interest bearing “greenbacks” paper money to finance the Civil War. Expansion and contraction of the money supply that led to the boom and bust economic cycle, and rampant bank failures. Early efforts to stabilize the money supply.

We discuss private banks hoarding gold and shrinking the money supply, Democratic presidential candidate, William Jennings Bryan, and his efforts to use gold and silver to back the US currency to increase the money supply, and early government infrastructure plans using government issued bonds, the origins of “The Wonderful Wizard of Oz” as a parable about the gold and silver political debate at the turn of the 19th century, the Federal Reserve Act of 1913, the stock market crash of 1929, the great depression, WWII’s effect on the money supply and the economic recovery it facilitated, and the Bretton Woods monetary system after World War II, making the US Dollar the world’s reserve currency. Nixon taking the US off of the gold standard in 1971, US government debt skyrocketing, the purpose of the Federal Reserve banking system, the cause of the boom and bust economic cycle, how the boom and bust cycle fuels arguments for socialism and against capitalism, the sub-prime mortgage crisis, and the great recession.

Additionally, we discuss some possible solutions to stabilize the monetary system, the economy, dealing with the ballooning national debt, eliminating the arguments for socialism and against capitalism, and how to create economic prosperity and stability for everyone.

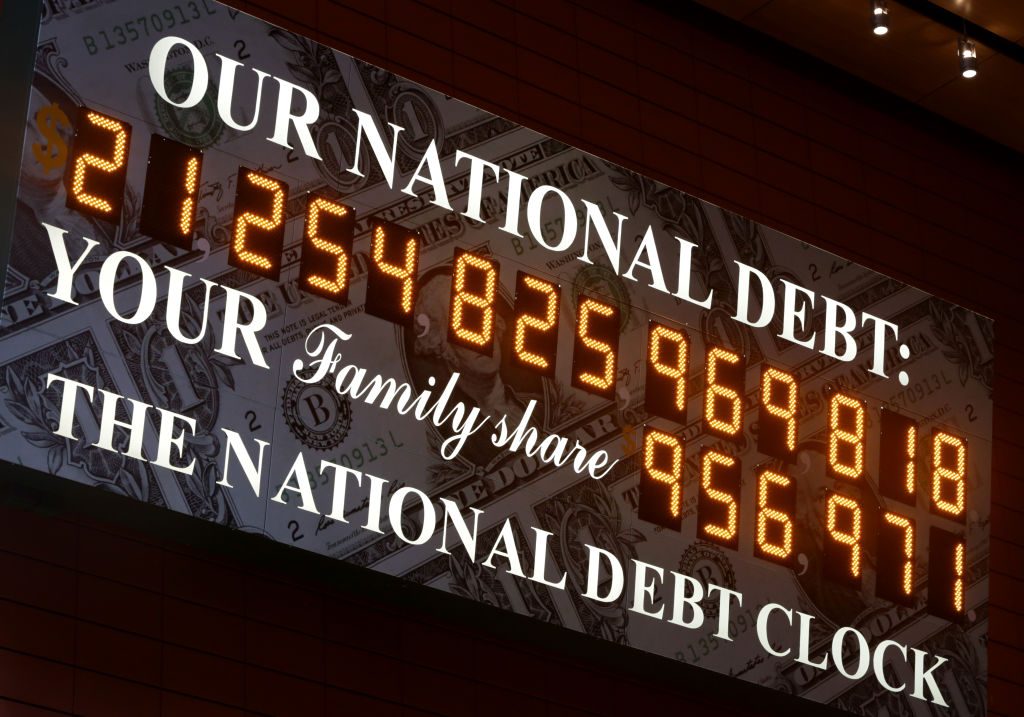

It’s been said, “money equals freedom.” But money can also enslave us if we go too far in debt. With U.S. Government debt topping $22 trillion dollars and American consumers another $14 trillion dollars in the red, some would say we’re already there.

“There are two ways to enslave a nation. One is by the sword. The other is by debt.” ~ attributed to John Adams

In many ways, the money supply is the power of the people. If managed responsibly, people are more likely to thrive. But the monetary system has flaws that let bankers manipulate markets to maximize profits and allow politicians to spend recklessly and saddle future generations with staggering debt. Unless these problems are fixed, the entire system is in danger of collapse.

The Federal Reserve Bank or “Fed” was created in 1913 to stabilize the U.S. money supply and create economic stability. It was given power to manage the money supply in order to separate banking from politics and prevent corruption. Instead, the Fed has presided over some 19 boom-bust cycles since 1913, including the Great Depression, the Great Recession, and the loss of 90-95% of the dollar’s value. Time and again, ordinary people have been impoverished and the rich empowered to buy up assets on the cheap.

With such a glaring record of failure, conspiracy theorists on the left and right have spun webs of blame around the Fed targeting global elites, international bankers, corrupt politicians and capitalist plunderers. The answer is far simpler — fiat money and fractional reserve banking create easy money that bankers and politicians can’t resist.

“We are completely dependent on the commercial banks. Someone has to borrow every dollar we have in circulation, cash or credit. If the Banks create ample synthetic money, we are prosperous; if not, we starve. We are absolutely without a permanent money system. When one gets a complete grasp of the picture, the tragic absurdity of our hopeless position is almost incredible, but there it is. It is the most important subject intelligent persons can investigate and reflect upon” ~ Robert H. Hemphill, former credit manager, Federal Reserve Bank of Atlanta

In Corey Wayne’s book, “Mastering Yourself,” he talks about how money is a medium of financial exchange and a store of individual financial value, and that only when we have sufficient money are we free to reach our full potential. The money supply is a public utility, and people have to understand how money works and circulates in the economy if we hope to improve the monetary system and make it work better for all of the people.

At its most basic, money is a token of financial value — a medium of financial exchange that makes commerce easier.

Three basic types of money are used in current global banking systems. “Commodity backed money” is paper money backed by something of value — like gold or silver — that stabilizes its relative value. “Receipt or representative money” is a piece of paper — like a check, or digital dollars — evidencing a deposit of something of value held by the issuer in a checking, savings, online brokerage or PayPal account. Then there is “Fiat money,” which most countries have today — government issued currency not backed by a physical commodity, but by the stability and credit of the government.

In his 2019 book, “Suicide of the West,” Jonah Goldberg observed that “the creation of money was the greatest advance in human liberation, because it lowered the burden to beneficial human interaction.” As a store of value, money lets us easily convert our individual skills, talents, time and assets into paper or digital receipts that allow us to freely buy and sell goods and services in the economy. Anything that diminishes money’s value or stability reduces our individual worth and limits our economic freedom and ability to pursue happiness.

America’s founding was as much about economic freedom as personal freedom — to create a country where people were free to pursue entrepreneurial endeavors with minimum tax and regulation and a reasonable expectation to keep most of the money earned — because as free people, we own the fruits of our own labor. Unfortunately, the current system undercuts that ideal by concentrating private control of the global financial, economic and monetary systems, and elevating government interests above the people. The resulting inequities betray free market capitalism and fuel arguments for socialism.

“I am afraid the ordinary citizen will not like to be told that the banks can and do create money. And they who control the credit of the nation direct the policy of Governments and hold in the hollow of their hand the destiny of the people.” ~ Reginald McKenna, Chairman of the Midland Bank

The simple fact is the Federal Reserve Bank acts like a money factory, creating new money out of U.S. government debt that it buys with fiat money that’s literally borrowed into existence by the U.S. Government.

Here’s how it works — when the federal government needs money to meet its spending needs, it prints government bonds and gives them to the Fed. The bonds are the Federal government’s written promise to repay what it borrows with interest. The Fed credits the government’s account with fiat money created out of thin air for that specific purpose. The government then issues checks to pay its expenses, such as wages to government workers or vendors, defense spending or social security, medicare and welfare benefits. The recipients of those government checks then deposit them into commercial banks, and these deposits help create additional bank credit for the nation’s businesses and individuals through the mechanism of fractional reserve banking.

It’s important to understand fractional reserve banking, because it’s another way money is created. In fact, it allows the banking system to take $1 and turn it into $10.

Here’s how it works — remember that money deposited into the banks by the recipients of those government checks? Let’s say that totaled $100,000. The banks are legally required to hold only 10% of the deposited money as reserves. Even though the bank account balance is $100,000, the bank can loan out 90% of that at interest to earn a profit for the bank.

This ratio applies to all bank deposits. So, if the Bank loans Mike $90,000 to buy an office building, once that $90,000 is deposited into the seller’s bank, their Account balance is $90,000. Did you see how money was just created?

On the Banking System books, there is now $190,000 — not just $100,000. $190,000. Now the seller’s bank can loan out 90% of the $90,000 — or $81,000 — to other borrowers.

Let’s stop and understand this. Adding it together, there’s now $271,000 on the books.

This process of fractional banking continues on and on as 90% of deposited monies continue to be loaned out by the banking system and deposited in other banks — multiplying the total amount of money created in the economy as a result of the first loan from $100,000 to as much as $1,000,000. That’s $900,000 of new money created out of thin air.

Where did we get that number? It’s determined by a financial ratio called the money multiplier which is, total bank deposits/.1 — the inverse of the 10% reserve ratio.

This equation estimates that the banking system can collectively generate up to 10 times the total amount of depositor monies held in reserve. The end result is that when the Fed adds $1 of new fiat money to the money supply to monetize government debt, the banking system creates $9 new dollars in the monetary system.

“The process by which banks create money is so simple the mind is repelled. With something so important, a deeper mystery seems only decent.” ~ John Kenneth Galbraith, professor of economics at Harvard

As the government issues bonds to support its spending and “sells” them to the federal reserve, the nation’s overall money supply in circulation increases. The problem is the government routinely issues bonds to make up for budget shortfalls or deficits when income tax revenues are insufficient to cover total government expenses. This is the bug in the system — it makes it too easy for politicians to engage in deficit spending — spending borrowed money at interest instead of having to increase taxes and take the heat from voters.

“Deficit spending is simply a scheme for the confiscation of wealth.” ~ Alan Greenspan

Because the borrowed money accrues interest, the wealth of the nation ends up siphoned off by income tax to pay interest. Meanwhile, steady increases in the money supply through the creation of new government and consumer debt results in hidden inflation that erodes the dollar’s value. This is why it takes $25 today to buy what $1 purchased in 1913.

John Maynard Keynes, one of the preeminent economists of the 20th century, described the problem:

“By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. By this method they not only confiscate, but they confiscate arbitrarily; and, while the process impoverishes many, it actually enriches some. The sight of this arbitrary rearrangement of riches strikes not only at security, but at confidence in the equity of the existing distribution of wealth. Those to whom the system brings windfalls, beyond their desserts and even beyond their expectations or desires, become “profiteers,” who are the object of the hatred of the bourgeoisie, whom the inflationism has impoverished, not less than of the proletariat. As the inflation proceeds and the real value of the currency fluctuates wildly from month to month, all permanent relations between debtors and creditors, which form the ultimate foundation of capitalism, become so utterly disordered as to be almost meaningless; and the process of wealth-getting degenerates into a gamble and a lottery.” ~ John Maynard Keynes

Fractional reserve banking is the mechanism that allows banks to create money from nothing. It came from an old trick whereby gold dealers storing gold coins for customers made loans at interest. They calculated they only needed to retain a reserve of 10% actual gold against the money lent out — as this was the most gold people might be expected to withdraw from the gold dealer at any one time.

In the early 1700s, a Scottish goldsmith named John Law first applied the trick to banking — touting it as a way to generate money from nothing. Law believed a national money supply could be created by government debt that had been monetized by being turned into paper money by private bankers.

For centuries, the people’s money in England had been represented by “tally sticks” made of wood. The government cut ridges denoting amounts of money into sticks of maple wood that never split the same way. The bank kept half the stick while the person borrowing the money got the other half. When the debt was paid off, the two parts of the stick were put back together.

By the 1700s, paper money backed by gold came to prominence. The tally sticks were collected and burned in 1834, sparking a massive fire that burned down Parliament. From the metaphorical ashes rose the Bank of England, the first central bank that would institutionalize fractional reserve banking and serve as the model for modern banks.

Before America’s founding, the Colonists were at odds with the central bankers in London. The colonies printed their own money called “the continental” to finance local government and pay taxes for the French-Indian war. Because the Colonies printed too much money too quickly before it could be taxed out of circulation, this resulted in hyperinflation that destroyed the Continental’s value.

British merchants had to accept depreciated colonial currency for their goods. In response to their complaints, the British passed a law to prohibit the Colonists from printing their own currency — forcing them to pay future taxes in silver, gold or Bank of England notes backed by precious metal. By taking away the Colonists’ ability to make their own paper money, the colonies suffered unemployment and dissatisfaction, which was a major cause of the Revolutionary war.

When the American Revolution broke out, there was insufficient gold or silver in the colonies to serve as an adequate money supply. The Continental Congress resumed printing currency to finance the war. As minutemen and redcoats clashed on the battlefield, the British waged economic war by counterfeiting the currency and flooding it into the colonies.

“The artists they employed performed so well that immense quantities of these counterfeits which issued from the British government in New York, were circulated among the inhabitants of all the states, before the fraud was detected. This operated significantly in depreciating the whole mass.” ~ Benjamin Franklin

By the time the war was over, the Continental was worthless. The founding fathers were disillusioned with paper money and wrote the Constitution to limit the Government’s financial power to coining money, regulating its value, and borrowing on the credit of the United States. The power to create paper money was not included.

As the new nation found its footing, Alexander Hamilton proposed a national bank — arguing that if the government couldn’t print money, it could create a national bank to do so and the government could borrow money from the bank.

“ A national debt, if not excessive, will be to us a national blessing, it will be a powerful cement of our union.” ~ Alexander Hamilton

Thomas Jefferson disagreed —

“I sincerely believe that banking establishments are more dangerous than standing armies; and that the principle of spending money to be paid by posterity, under the name of funding, is but swindling futurity on a large scale”~ Thomas Jefferson

From the seeds of this disagreement grew a national debate over the money supply and who controls it that continues to this day.

Despite Jefferson’s opposition, a national bank was chartered for a term of 20 years. But it was quickly seen as too fiscally conservative to keep up with the country’s economic growth, and Congress let the charter expire.

After the War of 1812, increasing industrialization and war debt made Congress reconsider. A second national bank was chartered in 1816 to allow the Treasury to regulate public credit issued by private banks and establish a sound and stable national currency.

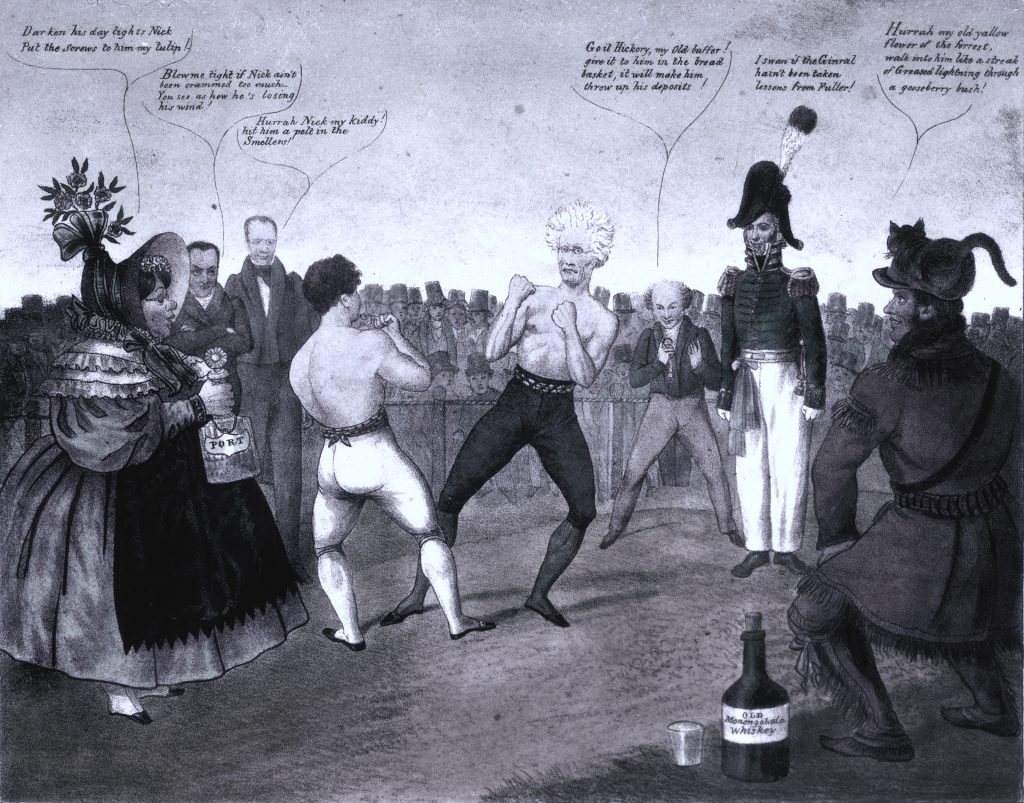

As the second national bank’s charter came up for renewal twenty years later, President Andrew Jackson was at war with the Bank’s president, Nicholas Biddle — charging the bank had failed to produce a stable national currency, and lacked constitutional legitimacy.

“Gentlemen! I too have been a close observer of the doings of the Bank of the United States. I have had men watching you for a long time, and am convinced that you have used the funds of the bank to speculate in the breadstuffs of the country. When you won, you divided the profits amongst you, and when you lost, you charged it to the bank. You tell me that if I take the deposits from the bank and annul its charter I shall ruin ten thousand families. That may be true, gentlemen, but that is your sin! Should I let you go on, you will ruin fifty thousand families, and that would be my sin! You are a den of vipers and thieves. I have determined to rout you out, and by the Eternal, I will rout you out!” ~ Andrew Jackson

Biddle forced an early vote on the Bank’s recharter while Jackson was running for re-election on an anti-bank platform. When Jackson vetoed the bill, Biddle poured bank money into an effort to defeat him. Jackson won re-election in a landslide and set out to destroy the bank by removing federal deposits. Biddle fought back, raising interest rates to deliberately cause a recession and force Jackson into a compromise.

“The ties of party allegiance can only be broken by the actual conviction of distress in the community. Nothing but the evidence of suffering abroad will produce any effect in Congress. I have no doubt that such a course will ultimately lead to restoration of the currency and the re-charter of the bank.” ~ Nicholas Biddle

Biddle’s effort backfired, and popular backlash forced him to abandon the fight. Congress voted to let the Bank’s charter expire.

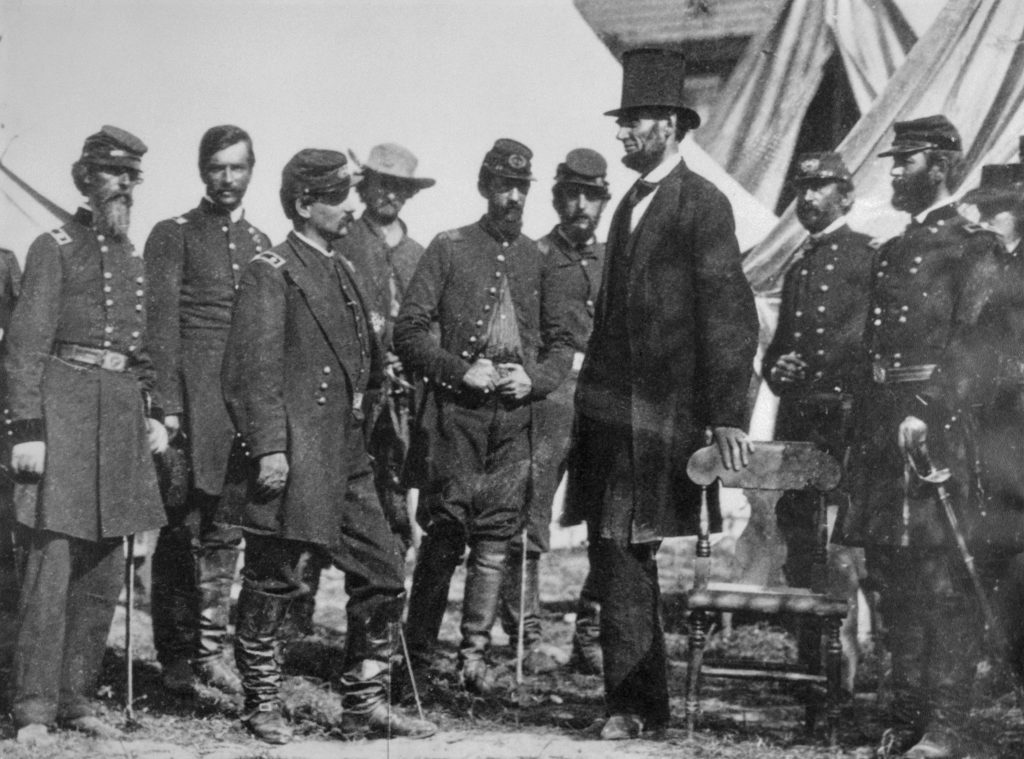

In the lead up to the Civil War, economic instability continued and there was rampant abuse in state banks with frequent bank failures. When Abraham Lincoln became President, he faced both a looming Civil War and a chaotic unregulated banking system that undermined the factory system and bogged down infrastructure development.

To finance the war, Eastern banks offered Lincoln an absurd loan package at usurious interest rates of 24-36%. Lincoln rejected the offer and printed non-interest bearing US Notes called Greenbacks that were used to pay soldiers and buy war supplies. As the war raged, Lincoln signed a National Banking Act into law in 1863 that attempted to establish a uniform banking system by creating a network of national banks and encouraging the development of a national currency.

After Lincoln’s assassination in 1865, international banking interests took the offensive. A law was passed in 1866 to curtail the Greenback and pave the way for the Gold Standard — but the actual effect was to reduce the money supply in circulation so there wasn’t enough to support the free trade of goods and services. Tightening of the money supply caused economic depression and unemployment. Bank runs were rampant where customers attempted to withdraw more currency than the bank held in reserve, forcing the bank into failure. Financial panics became the norm from 1873 to 1896 as a long depression set in with sustained price deflation and economic contraction.

In 1893, world events caused a major run on gold in the US Treasury. The money supply contracted sharply and unemployment rose to 25%. Farmers went bankrupt and lost their family farms. Bank runs dried up credit.

As the people suffered, the big issues remained unresolved — how to stabilize the money supply — and should control of the currency be in the hands of private citizens or the elected representatives of the people?

At the end of the 1800s, a national debate raged as to whether the money supply could be stabilized by pegging the currency to the value of gold. The problem was private banks held most of the gold and could manipulate prices, causing gold to be withdrawn from the market and hoarded which shrank the money supply.

A populist democrat, William Jennings Bryan was running against incumbent President William McKinley. Bryan advocated a solution — to use gold and silver to back the currency and immediately increase the money supply. A brilliant orator, Bryan gave his famous “Cross of Gold” speech at the 1896 Democratic presidential convention — arguing in opposition to the gold standard that “you shall not crucify mankind on a cross of gold.”

At the time, an Ohio businessman named Jacob Coxey led a popular protest march on Washington to demand Congress pass an infrastructure plan financed by $500 million dollars in currency backed by government bonds. Author, L. Frank Baum, witnessed the march and drew inspiration for his book “The Wonderful Wizard of Oz” — a parable of the money debate at the time.

In the book, Dorothy represented the American people — her slippers were silver, and symbolized Bryan’s silver solution to the money crisis — the wicked witches of the West and East represented President McKinley and the wall street bankers — the cowardly lion was Bryan who had a mighty roar but no political power — the scarecrow symbolized farmers ignorant of government financial policies — the tin man, factory workers frozen by unemployment — the yellow brick road was an illusion of the stability of the gold standard — Oz was the American dream unrealized — and the Wizard of Oz was the American president whose strings were being pulled behind the curtains by bankers.

“The people had been deluded into a belief in scarcity by defining their wealth in terms of a scarce commodity, gold. The country’s true wealth consisted of its goods and services, its resources and the creativity of its people.” ~ Ellen Brown, The Web of Debt

Bryan ended up losing the election, and the Gold standard was established in 1900 — but stabilizing the money supply remained elusive. After a financial panic in 1907, the stock market fell 50%. There was broad agreement to create a central banking system that could provide a more elastic currency and coordinate responses to financial panics.

To solve the problem, Nelson Aldrich — a powerful Republican senator and Chairman of the National Monetary Commission — convened a secret meeting on Jekyll Island, Georgia in 1910. In attendance were representatives of 1/4th of the world’s wealth — the John D. Rockefeller and JP Morgan banking consortiums — the Rothschild banking group of England and France — and the Warburg group from Germany and the Netherlands. The most powerful bankers in the world devised a legislative plan to create a central banking cartel and hide its true nature behind smoke and mirrors.

President Woodrow Wilson sought a middle ground between progressives such as Bryan — and Aldrich, who put forward the plan conceived at Jekyll Island, that gave private financial interests a large degree of control over the monetary system.

Wilson declared the banking system must be “public not private, [and] must be vested in the government itself so that the banks must be the instruments, not the masters, of business.”

Democratic Congressmen crafted a compromise in which private banks would control twelve regional Federal Reserve Banks, overseen by a central board filled with presidential appointees.

The Federal Reserve Act of 1913 passed after Wilson convinced Bryan’s supporters that the plan met their demands for an elastic currency because Federal Reserve notes would be government obligations. It enshrined a gold standard by fixing the price of gold and requiring the Fed to hold gold reserves equal to 40% of the value of currency it issued.

But the Federal Reserve was not what most people thought. It was not a federal bank. It was a collection of 12 private banks who now had virtual monopoly power to issue US dollars. Wilson would end up deeply regretting the bill.

“A great industrial nation is controlled by its system of credit. Our system of credit is privately concentrated. The growth of the nation, therefore, and all our activities are in the hands of a few men … We have come to be one of the worst ruled, one of the most completely controlled and dominated, governments in the civilized world—no longer a government by free opinion, no longer a government by conviction and the vote of the majority, but a government by the opinion and the duress of small groups of dominant men.” ~ Woodrow Wilson

Wilson’s fears were well-founded. Throughout the 1920s, the Fed recklessly increased the money supply by creating ever more debt and issuing easy credit. Middle-class Americans flooded into the stock market, buying up stocks on credit and fueling a market bubble.

When the stock market crashed in 1929, the money supply sharply contracted — shutting down commerce and plunging the world into the Great Depression. Gold was hoarded, and the Fed raised interest rates, making the Depression worse and forcing companies into bankruptcy.

“The elementary truth is that the Great Depression was produced by government mismanagement. It was not produced by the failure of private enterprise, it was produced by the failure of government to perform a function which had been assigned to it.” ~ Milton Friedman

By 1932, the Fed couldn’t increase the money supply because it was near the limit of currency that could be backed by the gold in its possession. The country was in deep trouble when Franklin Roosevelt was elected President on a promise to take government action to end the Great Depression.

When a run on gold reserves in 1933 threatened to bankrupt the country, Roosevelt took drastic action — closing all banks until they relinquished their gold to the Federal Reserve. Americans were ordered by law to turn their gold in for dollars. The intent was to remove the constraint on the Fed that was keeping it from increasing the money supply. President Roosevelt also came down hard on Wall Street and passed a new deal to stimulate the economy. But instead of printing interest-free money like Lincoln had with Greenbacks, he borrowed it at interest.

“The real truth of the matter is as you and I know, that a financial element in the larger centers has owned the government ever since the days of Andrew Jackson…” ~ Franklin D. Roosevelt

Despite Roosevelt’s efforts, the depression dragged on. It was only the widespread economic mobilization required by World War II that led to full employment and finally put an end to the depression.

To finance the production of weapons and war supplies for the Allied armies, the government borrowed money by printing war bonds and enlisting Hollywood celebrities to sell them to the public for cash. This resulted in a significant increase in the money supply in circulation and led to full employment.

As World War II neared its conclusion, the scale of destruction was enormous. The Allies realized the world would need a new financial system to facilitate global reconstruction.

In 1944, 44 nations met in Bretton Woods, New Hampshire and agreed to set the US dollar as the world’s reserve currency — backed by gold — since the U.S. held most of the world’s gold supply.

The new system remained in effect until 1971 when the US gold supply was no longer adequate to cover the total number of dollars in circulation. President Richard Nixon rendered Bretton Woods inoperative by suspending the convertibility of the dollar into Gold. From now on, currency exchange rates would float freely and not be tied to the value of gold. This removed the only effective check on the Fed’s ability to expand the money supply exponentially as it wished, and freed up the politicians to spend without limit by issuing government debt.

The ugly truth is that since 1971, boom/bust cycles have continued while US Government debt has steadily increased from $400 billion dollars in 1971 to over $22 trillion dollars today. Taxpayers are paying more and more interest on a ballooning national debt as bankers create ever more money from nothing and loan it out at interest.

The Fed is supposed to keep the money supply and economy stable and help achieve full employment by adjusting short term interest rates and bank deposit reserve requirements as needed to cool down or heat up the economy. When interest rates or reserve requirements are increased, the money supply contracts and asset prices go down because fewer people have the money to buy them. When interest rates or reserve requirements are lowered, the money supply expands and asset prices go up because people have more money to buy them. If the Fed does this in an uneven way, the economy suffers boom and bust cycles that excessively inflate and deflate asset prices. This is what creates the temptation for bankers to manipulate markets by artificially creating boom/bust cycles that enable the wealthy to buy up assets at deflated prices.

“Buy when there’s blood in the streets, even if the blood is your own.” ~ attributed to Baron Rothschild

The biggest boom/bust of all began in 2007 when a housing bubble burst and the subprime mortgage market crashed.

This time, politicians had manipulated real estate lending to expand home ownership, fostering a subprime mortgage market by giving government guarantees for FHA, VA, Fannie Mae, and Freddie Mac loans, and pressuring the lending industry to make mortgage loans to people with bad credit. The result was an unprecedented housing boom with rampant mortgage fraud, predatory lending and hyper-inflated home values. Wall Street compounded the problem by bundling subprime loans and selling them as derivative securities backed by credit default insurance to the tune of some $60 trillion dollars.

When the Fed started raising interest rates too fast, people could no longer afford their monthly mortgage payments, because most subprime mortgages had adjustable interest rates that closely tracked the Fed’s prime rate and the LIBOR or London Inter-bank Offered rate. Interest rates weren’t fixed but could be adjusted by the lender on a monthly, quarterly, bi-annual or annual basis. As interest rates rose, more and more people went into default, because they couldn’t afford the higher monthly payments. The Fed was caught flat-footed, claiming they were unaware just how massive the subprime mortgage derivative market had become. The whole house of cards came crashing down, causing a global recession.

To prevent a complete meltdown, the US Government injected at least $1.9 trillion dollars into the banking system through the Fed and bailed out banks and companies considered too big to fail. The total commitment to bank bailouts is believed to exceed $16 trillion dollars. The Great Recession is estimated to have cost every American a minimum of $70,000 — or $24.5 trillion dollars in total. Whatever the true cost, the American people will be paying it for a long time to come.

“Is there any reason why the American people should be taxed to guarantee the debts of banks, any more than they should be taxed to guarantee the debts of other institutions, including merchants, the industries, and the mills of the country?” ~ Senator Carter Glass, Author of the Glass-Steagall Banking Act of 1933

Despite everything that’s been tried, creating a stable and elastic money supply has remained one of our greatest challenges.

Since the Great Recession, markets have largely recovered, but the flaws in the monetary system remain. Family income has dropped and the wealth gap has widened, while the national debt has spiked from $9 trillion dollars in 2007 to $22 trillion today, further eroding the dollar’s value. Interest costs on the national debt are $389 billion dollars in 2019. The Congressional Budget Office projects an increase to $914 billion by 2028. The ugly truth is the politicians and bankers are drowning us in debt and the American people are on the hook to pay for it.

“Lenin is said to have declared that the best way to destroy the Capitalistic System was to debauch the currency… Lenin was certainly right. There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million can diagnose.” ~ John Maynard Keynes

Given the Fed’s history, people on the left and right feel the system is rigged to make the rich richer and poor poorer. There’s no question some big banks and large transnational corporations have been protected from the consequences of risky business practices and their losses passed on to the U.S. taxpayer. The bottom line is the Fed has failed in its most important function — to maintain stability in the economy and a stable money supply.

We can think of the national economy as a giant swimming pool with the water representing money that streams in from several faucets, and flows out through several drains. The goal of monetary policy is to maintain a stable water level in the pool. When new money is created — such as when the US Government borrows money — or American consumers and corporations borrow money to buy homes, office buildings, cars and boats, or to make credit card purchases — or when foreign corporations open offices or build factories in the U.S — or foreign investors buy homes or stock in American companies — or when American companies return to the US to take advantage of lower taxes — it’s like turning on the tap to let more water in.

But water runs out when loans are paid off — when illegal and legal workers send money to relatives in their home countries — when companies fire their employees and move their cash and operations overseas — when we run trade deficits that send cash permanently out of our economy to circulate in foreign economies in exchange for their products — when the US government spends money on foreign aid — or when we buy oil or other commodities from foreign countries.

The Fed is supposed to oversee the velocity of cash flow to the faucets, priming the pump with interest rate or reserve adjustments when the water level drops, rises or becomes unstable. It works in theory until there’s a huge spike in money leaving the pool, which has the effect of stranding people on the shore, because there isn’t enough money for them to float in the economic pool. This is what happened in 2007 when the market collapse drained some $3 trillion dollars from the money supply almost overnight and caused the Great Recession.

Fixing the problem will require finding better tools to stabilize the money supply — adding new faucets that can quickly inject money into the economy in times of market and economic turmoil. And it requires ending the temptations that enable bankers and politicians to make bad monetary and economic decisions and pass the bill on to the taxpayers.

“He who introduces a new order of things has all those who profit from the old order as his enemies, and he has only lukewarm allies in all those who might profit from the new.” ~ Niccolo Machiavelli

Modifying the monetary system won’t be easy, but there are several things we should all be able to agree on. No bank or corporation should be bailed out by taxpayers for making bad business decisions. Bankers shouldn’t have the exclusive right to create the nation’s money supply from nothing and lend it out at interest. And politicians shouldn’t be able to run up massive government debts and burden future generations with higher taxes to pay the interest.

If we are to truly have free markets that serve the interests of the people, bankers simply can’t have unchecked control of the tools to manipulate them. And while government has a clear role in overseeing the economy, the Fed needs to remain mostly independent, as too much power in the hands of politicians invariably leads to disaster.

Socialist politicians consistently destroy the value of their currency by asserting too much government control. This is what happened when oil-rich Venezuela elected socialist leader, Hugo Chavez. He promised the poor everything, while demonizing capitalism and the rich and seizing private property. Money fled the country, and the supply of cash circulating in the economic pool emptied out. Foreign banks no longer accepted Venezuelan currency, and foreign investors no longer wanted to invest in Venezuela because the government might confiscate their companies and assets for pennies on the dollar. The government printed excessive digital and paper money to try to make up the shortfall, rendering the Venezuelan currency worthless. The result is the financial and humanitarian disaster we see today.

To make our monetary system truly responsive to the needs of the people, we should learn from the past and use new technologies to make us smarter. Artificial Intelligence might be tasked to analyze the country’s financial history and our current monetary system and recommend the optimal monetary cashflows to improve and permanently stabilize it — eliminating the destructive boom and bust cycles once and for all.

We could pull back the curtain and rename the national debt what it really is — the “US Treasury created money supply.” We should find ways to phase out interest-bearing national debt, replacing it with extremely low or zero percent interest bearing loans on infrastructure projects — and we should supplement the system with additional money injection faucets to keep a stable level of money in the economic pool.

Additional faucets might include creating a Universal Basic Income (UBI) faucet from the US Treasury — developing State Bank faucets to meet infrastructure needs — and creating 38 additional Federal Reserve banks to be based in each state that are closer in proximity to their communities and can be more responsive to the monetary cash-flow needs of local economies. These additional faucets could help stabilize the money supply in circulation at the federal, state and local level.

Ellen Brown, President of the Public Banking Institute and author of “The Web of Debt,” believes infrastructure needs could best be met by establishing public development banks at the state level to lend money out for approved infrastructure projects.

“The main flaw in the current model is that private profiteers have acquired control of the money spigots. They can cut off the flow, direct it to their cronies, and manipulate it for personal gain at the expense of the producing economy. The benefits of bank credit can be maintained while eliminating these flaws, through a system of banks operated as public utilities, serving the public interest and returning their profits to the public.” ~ Ellen Brown

The public bank of North Dakota is a good example. State revenues are deposited in the public bank instead of private banks, and it provides low interest loans to pay for the state’s needs. Even during the Great Recession, the unemployment rate in North Dakota remained steady because the bank was able to stabilize the money supply circulating in the state and local economies.

In 2002, future Fed Chairman Ben Bernanke floated the idea of “helicopter money” that could be broadly spread across the economy to increase the money supply in times of contraction. He suggested “Congress might create a special Treasury account at the Fed, and give the Fed sole authority to fill the account up to some prespecified level. Funds would be added to the account only if the Fed decided a “helicopter drop” of a specified amount to the national money supply was needed to achieve the Fed’s employment and inflation goals.” This would act like an additional faucet that could enable the Fed to inject money directly into the system in specific locations and widely distribute funds to the public in times of market contraction, without risking too much coordination between Congress and the central bank.

Another idea gaining traction is Universal Basic Income or UBI, in which every citizen, whether employed or not, would receive a fixed periodic sum of money from the government with no strings attached.

With Artificial Intelligence and automation expected to make 75 million American jobs redundant by the year 2025, UBI deserves a serious look. The rationale is, if banks create money out of thin air for private loans and government spending, why not do the same to create basic economic stability for everyone?

It’s possible welfare and government benefits could be replaced with a UBI, so the money supply is more stable and the economy less vulnerable to boom/bust cycles. This would give people a secure financial base to cover the basic needs of life and free them up to be more productive by doing work they love and enjoy. Instead of struggling to put food on the table and a roof over their head, people could be empowered to pursue their passions and contribute to the world in unique and creative ways.

The bottom line is the monetary system needs to be enhanced to help people protect and improve their store of personal financial value and provide a stable cash flow for their life’s work. Since people get paid based on the value they bring to the marketplace, getting paid more is the result of developing their gifts, skills and talents and growing their reserve of knowledge. It’s human nature that people will work harder at things they love and enjoy. With a stable and elastic money supply, people willing to work for it can be freed to reach their full and highest potential. This is why enhancing the monetary system should be a top priority — because it’s central to individual liberty and the pursuit of happiness — and the key to creating a more prosperous and equitable society for all.

In the meantime, if people worry about the value of the dollar and being vulnerable to mismanagement of the money supply by the bankers and politicians, they can move part of their store of financial value outside the banking system and into alternatives such as cryptocurrencies based on blockchain — foreign currencies — and physical assets like precious metals, art and real estate. Having a portion of value stored in alternative vehicles serves as a hedge that can help insulate us from the worst effects of money instability and bad monetary policy.

Blockchain in particular is largely independent of the monetary and banking systems and immunized from currency volatility. The more widely accepted it becomes, the more people might seek refuge in cryptocurrencies that aren’t as vulnerable to the steady erosion of the dollar’s value caused by government deficit spending. It’s a separate spigot individuals could tap into to stay afloat when the economy gets turbulent and unstable.

While there are no silver bullets, adding new money faucets to the national economy could help keep the water level in the pool of cash more stable and make the money supply more elastic to meet our collective financial needs.

By limiting the ability of banks and large corporations to be bailed out at taxpayer expense and stopping politicians from spending recklessly and depreciating the value of our currency, we might finally bring an end to long-standing complaints against both capitalism and government.

In the big picture, we might be able to solve all kinds of societal problems and narrow the gaps between rich and poor — and left and right. And most importantly, the American promise of individual liberty and prosperity can be restored for all the people.

“Money might indeed become a servant of humanity, transformed from a tool of oppression into a means of securing common prosperity. But first, the central bank needs to become a public servant. It needs to be made a public utility, responsive to the needs of the people and the economy.” ~ Ellen Brown

You can learn more by reading Corey Wayne’s book, “Mastering Yourself” for FREE on his website UnderstandingRelationships.com by subscribing to the newsletter.

Get the Book “How To Be A 3% Man”

*Amazon and the Amazon logo are trademarks of Amazon.com, Inc. or its affiliates. As an Amazon Associate I earn from qualifying purchases. **Free with a new Audible.com membership

*Amazon and the Amazon logo are trademarks of Amazon.com, Inc. or its affiliates. As an Amazon Associate I earn from qualifying purchases.

How to Be a 3% Man

Paperback | $29.99

How to Be a 3% Man

Hardcover | $49.99

How to Be a 3% Man

Paperback | $29.99

How to Be a 3% Man

Hardcover | $49.99

*Amazon and the Amazon logo are trademarks of Amazon.com, Inc. or its affiliates. As an Amazon Associate I earn from qualifying purchases.

Get the Book “Mastering Yourself”

*Amazon and the Amazon logo are trademarks of Amazon.com, Inc. or its affiliates. As an Amazon Associate I earn from qualifying purchases. **Free with a new Audible.com membership

*Amazon and the Amazon logo are trademarks of Amazon.com, Inc. or its affiliates. As an Amazon Associate I earn from qualifying purchases.

Mastering Yourself

Paperback | $49.99

Mastering Yourself

Hardcover | $99.99

Mastering Yourself

Paperback | $49.99

Mastering Yourself

Hardcover | $99.99

*Amazon and the Amazon logo are trademarks of Amazon.com, Inc. or its affiliates. As an Amazon Associate I earn from qualifying purchases.

Get the Book “Quotes, Ruminations & Contemplations”

*Amazon and the Amazon logo are trademarks of Amazon.com, Inc. or its affiliates. As an Amazon Associate I earn from qualifying purchases. **Free with a new Audible.com membership

*Amazon and the Amazon logo are trademarks of Amazon.com, Inc. or its affiliates. As an Amazon Associate I earn from qualifying purchases.

Quotes, Ruminations & Contemplations

Paperback | $49.99

Quotes, Ruminations & Contemplations

Hardcover | $99.99

*Amazon and the Amazon logo are trademarks of Amazon.com, Inc. or its affiliates. As an Amazon Associate I earn from qualifying purchases.

If you have a question you would like me to consider answering in a future Video Coaching Newsletter, you can send it (3-4 paragraphs/500 words max) to this email address: [email protected]

If you feel I have added value to your life, you can show your appreciation by doing one of the following three things:

- Make a donation to my work by clicking here to donate via PayPal anytime you feel I have added significant value to your life. You tip your favorite bartender, right? How about a buck... $2... $3... $5... $10... $20... what ever YOU feel its worth, every time you feel I have given you a good tip, new knowledge or helpful insight. Please feel free to donate any amount you think is equal to the value you received from my eBook & Home Study Course (audio lessons), articles, videos, emails, newsletters, etc.

- Referring your friends and family to this website so they can start learning and improving their dating and relationship life, happiness, balance and overall success in every area of their lives too!

- Purchase a phone/Zoom (audio only) coaching session for yourself or a friend by clicking here. Download the Amazon.com Kindle version of my book to your Kindle, Smartphone, Mac or PC for only $9.99 by clicking here. Get the iBook version for $9.99 from the iBookstore by clicking here. Get the Audio Book for FREE $0.00 with an Audible.com membership by clicking here or buy it for $19.95 at Amazon.com by clicking here. Get the iTunes Audio Book for $19.95 by clicking here. That way, you'll always have it with you to reference when you need it most. Thank you for reading this message!

From my heart to yours,

Corey Wayne

Author, Speaker, Peak Performance Coach, Entrepreneur

Click Anywhere on Today’s Instagram Image Below & You’ll Be Taken To My Instagram Page. When you get to my Instagram page, click the “Follow” Button so you can follow me on Instagram. I upload several new Instagram photos per week.

Leave A Reply