In Episode 1 – “Money Is Freedom” of this 4 part documentary on the monetary system, “Power To The People,” we discuss the purpose of money, where money comes from, how the banking system creates money, how fractional reserve banking works, the different types of money in use in the global economy and the basics of how money circulates in the economy. We also talk about how the boom and bust cycle fuels arguments against free market capitalism and for socialism.

It’s been said, “money equals freedom.” But money can also enslave us if we go too far in debt. With U.S. Government debt topping $22 trillion dollars and American consumers another $14 trillion dollars in the red, some would say we’re already there.

“There are two ways to enslave a nation. One is by the sword. The other is by debt.” ~ attributed to John Adams

In many ways, the money supply is the power of the people. If managed responsibly, people are more likely to thrive. But the monetary system has flaws that let bankers manipulate markets to maximize profits and allow politicians to spend recklessly and saddle future generations with staggering debt. Unless these problems are fixed, the entire system is in danger of collapse.

The Federal Reserve Bank or “Fed” was created in 1913 to stabilize the U.S. money supply and create economic stability. It was given power to manage the money supply in order to separate banking from politics and prevent corruption. Instead, the Fed has presided over some 19 boom-bust cycles since 1913, including the Great Depression, the Great Recession, and the loss of 90-95% of the dollar’s value. Time and again, ordinary people have been impoverished and the rich empowered to buy up assets on the cheap.

With such a glaring record of failure, conspiracy theorists on the left and right have spun webs of blame around the Fed targeting global elites, international bankers, corrupt politicians and capitalist plunderers. The answer is far simpler — fiat money and fractional reserve banking create easy money that bankers and politicians can’t resist.

“We are completely dependent on the commercial banks. Someone has to borrow every dollar we have in circulation, cash or credit. If the Banks create ample synthetic money, we are prosperous; if not, we starve. We are absolutely without a permanent money system. When one gets a complete grasp of the picture, the tragic absurdity of our hopeless position is almost incredible, but there it is. It is the most important subject intelligent persons can investigate and reflect upon” ~ Robert H. Hemphill, former credit manager, Federal Reserve Bank of Atlanta

In Corey Wayne’s book, “Mastering Yourself,” he talks about how money is a medium of financial exchange and a store of individual financial value, and that only when we have sufficient money are we free to reach our full potential. The money supply is a public utility, and people have to understand how money works and circulates in the economy if we hope to improve the monetary system and make it work better for all of the people.

At its most basic, money is a token of financial value — a medium of financial exchange that makes commerce easier.

Three basic types of money are used in current global banking systems. “Commodity backed money” is paper money backed by something of value — like gold or silver — that stabilizes its relative value. “Receipt or representative money” is a piece of paper — like a check, or digital dollars — evidencing a deposit of something of value held by the issuer in a checking, savings, online brokerage or PayPal account. Then there is “Fiat money,” which most countries have today — government issued currency not backed by a physical commodity, but by the stability and credit of the government.

In his 2019 book, “Suicide of the West,” Jonah Goldberg observed that “the creation of money was the greatest advance in human liberation, because it lowered the burden to beneficial human interaction.” As a store of value, money lets us easily convert our individual skills, talents, time and assets into paper or digital receipts that allow us to freely buy and sell goods and services in the economy. Anything that diminishes money’s value or stability reduces our individual worth and limits our economic freedom and ability to pursue happiness.

America’s founding was as much about economic freedom as personal freedom — to create a country where people were free to pursue entrepreneurial endeavors with minimum tax and regulation and a reasonable expectation to keep most of the money earned — because as free people, we own the fruits of our own labor. Unfortunately, the current system undercuts that ideal by concentrating private control of the global financial, economic and monetary systems, and elevating government interests above the people. The resulting inequities betray free market capitalism and fuel arguments for socialism.

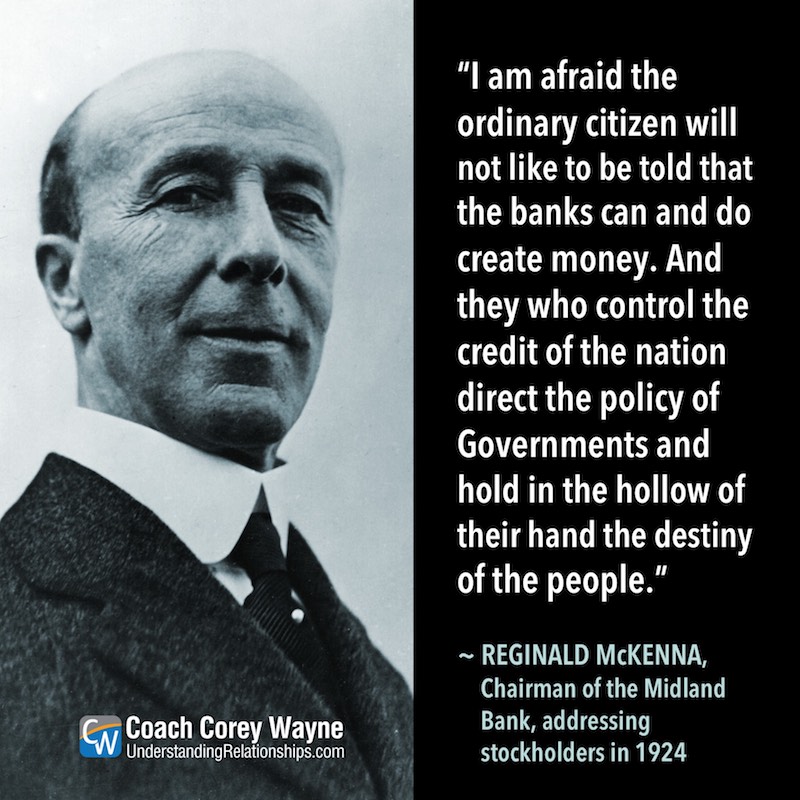

“I am afraid the ordinary citizen will not like to be told that the banks can and do create money. And they who control the credit of the nation direct the policy of Governments and hold in the hollow of their hand the destiny of the people.” ~ Reginald McKenna, Chairman of the Midland Bank

The simple fact is the Federal Reserve Bank acts like a money factory, creating new money out of U.S. government debt that it buys with fiat money that’s literally borrowed into existence by the U.S. Government.

Here’s how it works — when the federal government needs money to meet its spending needs, it prints government bonds and gives them to the Fed. The bonds are the Federal government’s written promise to repay what it borrows with interest. The Fed credits the government’s account with fiat money created out of thin air for that specific purpose. The government then issues checks to pay its expenses, such as wages to government workers or vendors, defense spending or social security, medicare and welfare benefits. The recipients of those government checks then deposit them into commercial banks, and these deposits help create additional bank credit for the nation’s businesses and individuals through the mechanism of fractional reserve banking.

It’s important to understand fractional reserve banking, because it’s another way money is created. In fact, it allows the banking system to take $1 and turn it into $10.

Here’s how it works — remember that money deposited into the banks by the recipients of those government checks? Let’s say that totaled $100,000. The banks are legally required to hold only 10% of the deposited money as reserves. Even though the bank account balance is $100,000, the bank can loan out 90% of that at interest to earn a profit for the bank.

This ratio applies to all bank deposits. So, if the Bank loans Mike $90,000 to buy an office building, once that $90,000 is deposited into the seller’s bank, their Account balance is $90,000. Did you see how money was just created?

On the Banking System books, there is now $190,000 — not just $100,000. $190,000. Now the seller’s bank can loan out 90% of the $90,000 — or $81,000 — to other borrowers.

Let’s stop and understand this. Adding it together, there’s now $271,000 on the books.

This process of fractional banking continues on and on as 90% of deposited monies continue to be loaned out by the banking system and deposited in other banks — multiplying the total amount of money created in the economy as a result of the first loan from $100,000 to as much as $1,000,000. That’s $900,000 of new money created out of thin air.

Where did we get that number? It’s determined by a financial ratio called the money multiplier which is, total bank deposits/.1 — the inverse of the 10% reserve ratio.

This equation estimates that the banking system can collectively generate up to 10 times the total amount of depositor monies held in reserve. The end result is that when the Fed adds $1 of new fiat money to the money supply to monetize government debt, the banking system creates $9 new dollars in the monetary system.

“The process by which banks create money is so simple the mind is repelled. With something so important, a deeper mystery seems only decent.” ~ John Kenneth Galbraith, professor of economics at Harvard

As the government issues bonds to support its spending and “sells” them to the federal reserve, the nation’s overall money supply in circulation increases. The problem is the government routinely issues bonds to make up for budget shortfalls or deficits when income tax revenues are insufficient to cover total government expenses. This is the bug in the system — it makes it too easy for politicians to engage in deficit spending — spending borrowed money at interest instead of having to increase taxes and take the heat from voters.

“Deficit spending is simply a scheme for the confiscation of wealth.” ~ Alan Greenspan

Because the borrowed money accrues interest, the wealth of the nation ends up siphoned off by income tax to pay interest. Meanwhile, steady increases in the money supply through the creation of new government and consumer debt results in hidden inflation that erodes the dollar’s value. This is why it takes $25 today to buy what $1 purchased in 1913.

John Maynard Keynes, one of the preeminent economists of the 20th century, described the problem:

“By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. By this method they not only confiscate, but they confiscate arbitrarily; and, while the process impoverishes many, it actually enriches some. The sight of this arbitrary rearrangement of riches strikes not only at security, but at confidence in the equity of the existing distribution of wealth. Those to whom the system brings windfalls, beyond their desserts and even beyond their expectations or desires, become “profiteers,” who are the object of the hatred of the bourgeoisie, whom the inflationism has impoverished, not less than of the proletariat. As the inflation proceeds and the real value of the currency fluctuates wildly from month to month, all permanent relations between debtors and creditors, which form the ultimate foundation of capitalism, become so utterly disordered as to be almost meaningless; and the process of wealth-getting degenerates into a gamble and a lottery.” ~ John Maynard Keynes

In episode 2 we’ll find out how fiat money and fractional reserve banking came to dominate our national banking system— and how the idea of a central bank has been a flashpoint in American politics since the nation’s beginning.

You can learn more by reading Corey Wayne’s book, “Mastering Yourself” for FREE on his website UnderstandingRelationships.com by subscribing to the newsletter.

Get the Book “How To Be A 3% Man”

*Amazon and the Amazon logo are trademarks of Amazon.com, Inc. or its affiliates. As an Amazon Associate I earn from qualifying purchases. **Free with a new Audible.com membership

*Amazon and the Amazon logo are trademarks of Amazon.com, Inc. or its affiliates. As an Amazon Associate I earn from qualifying purchases.

How to Be a 3% Man

Paperback | $29.99

How to Be a 3% Man

Hardcover | $49.99

How to Be a 3% Man

Paperback | $29.99

How to Be a 3% Man

Hardcover | $49.99

*Amazon and the Amazon logo are trademarks of Amazon.com, Inc. or its affiliates. As an Amazon Associate I earn from qualifying purchases.

Get the Book “Mastering Yourself”

*Amazon and the Amazon logo are trademarks of Amazon.com, Inc. or its affiliates. As an Amazon Associate I earn from qualifying purchases. **Free with a new Audible.com membership

*Amazon and the Amazon logo are trademarks of Amazon.com, Inc. or its affiliates. As an Amazon Associate I earn from qualifying purchases.

Mastering Yourself

Paperback | $49.99

Mastering Yourself

Hardcover | $99.99

Mastering Yourself

Paperback | $49.99

Mastering Yourself

Hardcover | $99.99

*Amazon and the Amazon logo are trademarks of Amazon.com, Inc. or its affiliates. As an Amazon Associate I earn from qualifying purchases.

Get the Book “Quotes, Ruminations & Contemplations”

*Amazon and the Amazon logo are trademarks of Amazon.com, Inc. or its affiliates. As an Amazon Associate I earn from qualifying purchases. **Free with a new Audible.com membership

*Amazon and the Amazon logo are trademarks of Amazon.com, Inc. or its affiliates. As an Amazon Associate I earn from qualifying purchases.

Quotes, Ruminations & Contemplations

Paperback | $49.99

Quotes, Ruminations & Contemplations

Hardcover | $99.99

*Amazon and the Amazon logo are trademarks of Amazon.com, Inc. or its affiliates. As an Amazon Associate I earn from qualifying purchases.

If you have a question you would like me to consider answering in a future Video Coaching Newsletter, you can send it (3-4 paragraphs/500 words max) to this email address: [email protected]

If you feel I have added value to your life, you can show your appreciation by doing one of the following three things:

- Make a donation to my work by clicking here to donate via PayPal anytime you feel I have added significant value to your life. You tip your favorite bartender, right? How about a buck... $2... $3... $5... $10... $20... what ever YOU feel its worth, every time you feel I have given you a good tip, new knowledge or helpful insight. Please feel free to donate any amount you think is equal to the value you received from my eBook & Home Study Course (audio lessons), articles, videos, emails, newsletters, etc.

- Referring your friends and family to this website so they can start learning and improving their dating and relationship life, happiness, balance and overall success in every area of their lives too!

- Purchase a phone/Zoom (audio only) coaching session for yourself or a friend by clicking here. Download the Amazon.com Kindle version of my book to your Kindle, Smartphone, Mac or PC for only $9.99 by clicking here. Get the iBook version for $9.99 from the iBookstore by clicking here. Get the Audio Book for FREE $0.00 with an Audible.com membership by clicking here or buy it for $19.95 at Amazon.com by clicking here. Get the iTunes Audio Book for $19.95 by clicking here. That way, you'll always have it with you to reference when you need it most. Thank you for reading this message!

From my heart to yours,

Corey Wayne

Author, Speaker, Peak Performance Coach, Entrepreneur

Click Anywhere on Today’s Instagram Image Below & You’ll Be Taken To My Instagram Page. When you get to my Instagram page, click the “Follow” Button so you can follow me on Instagram. I upload several new Instagram photos per week.

life says

Very nice write-up. I certainly love this website. Stick with it!