In Episode 2 – “Money From Nothing” of this 4 part documentary on the monetary system, “Power To The People,” we discuss the origins of fractional reserve banking and where money comes from, how government debt became the national money supply, and the history of money using wooden tally sticks, gold, silver and paper money.

We also discuss the history and origins of central banking, the first central bank, the bank of England, which became the model for modern banking. Hyperinflation and how it destroys the value of paper money. The first central banks of the United States. Andrew Jackson and his fight against central banking and corrupt bankers. Abraham Lincoln’s use of non-interest bearing “greenbacks” paper money to finance the Civil War. Expansion and contraction of the money supply that led to the boom and bust economic cycle, and rampant bank failures. Early efforts to stabilize the money supply.

Fractional reserve banking is the mechanism that allows banks to create money from nothing. It came from an old trick whereby gold dealers storing gold coins for customers made loans at interest. They calculated they only needed to retain a reserve of 10% actual gold against the money lent out — as this was the most gold people might be expected to withdraw from the gold dealer at any one time.

In the early 1700s, a Scottish goldsmith named John Law first applied the trick to banking — touting it as a way to generate money from nothing. Law believed a national money supply could be created by government debt that had been monetized by being turned into paper money by private bankers.

For centuries, the people’s money in England had been represented by “tally sticks” made of wood. The government cut ridges denoting amounts of money into sticks of maple wood that never split the same way. The bank kept half the stick while the person borrowing the money got the other half. When the debt was paid off, the two parts of the stick were put back together.

By the 1700s, paper money backed by gold came to prominence. The tally sticks were collected and burned in 1834, sparking a massive fire that burned down Parliament. From the metaphorical ashes rose the Bank of England, the first central bank that would institutionalize fractional reserve banking and serve as the model for modern banks.

Before America’s founding, the Colonists were at odds with the central bankers in London. The colonies printed their own money called “the continental” to finance local government and pay taxes for the French-Indian war. Because the Colonies printed too much money too quickly before it could be taxed out of circulation, this resulted in hyperinflation that destroyed the Continental’s value.

British merchants had to accept depreciated colonial currency for their goods. In response to their complaints, the British passed a law to prohibit the Colonists from printing their own currency — forcing them to pay future taxes in silver, gold or Bank of England notes backed by precious metal. By taking away the Colonists’ ability to make their own paper money, the colonies suffered unemployment and dissatisfaction, which was a major cause of the Revolutionary war.

When the American Revolution broke out, there was insufficient gold or silver in the colonies to serve as an adequate money supply. The Continental Congress resumed printing currency to finance the war. As minutemen and redcoats clashed on the battlefield, the British waged economic war by counterfeiting the currency and flooding it into the colonies.

“The artists they employed performed so well that immense quantities of these counterfeits which issued from the British government in New York, were circulated among the inhabitants of all the states, before the fraud was detected. This operated significantly in depreciating the whole mass.” ~ Benjamin Franklin

By the time the war was over, the Continental was worthless. The founding fathers were disillusioned with paper money and wrote the Constitution to limit the Government’s financial power to coining money, regulating its value, and borrowing on the credit of the United States. The power to create paper money was not included.

As the new nation found its footing, Alexander Hamilton proposed a national bank — arguing that if the government couldn’t print money, it could create a national bank to do so and the government could borrow money from the bank.

“ A national debt, if not excessive, will be to us a national blessing, it will be a powerful cement of our union.” ~ Alexander Hamilton

Thomas Jefferson disagreed —

“I sincerely believe that banking establishments are more dangerous than standing armies; and that the principle of spending money to be paid by posterity, under the name of funding, is but swindling futurity on a large scale”~ Thomas Jefferson

From the seeds of this disagreement grew a national debate over the money supply and who controls it that continues to this day.

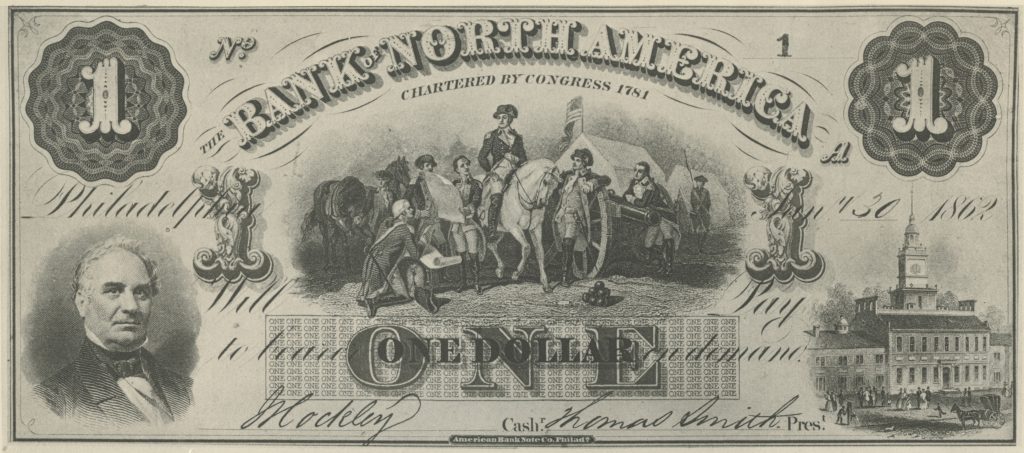

Despite Jefferson’s opposition, a national bank was chartered for a term of 20 years. But it was quickly seen as too fiscally conservative to keep up with the country’s economic growth, and Congress let the charter expire.

After the War of 1812, increasing industrialization and war debt made Congress reconsider. A second national bank was chartered in 1816 to allow the Treasury to regulate public credit issued by private banks and establish a sound and stable national currency.

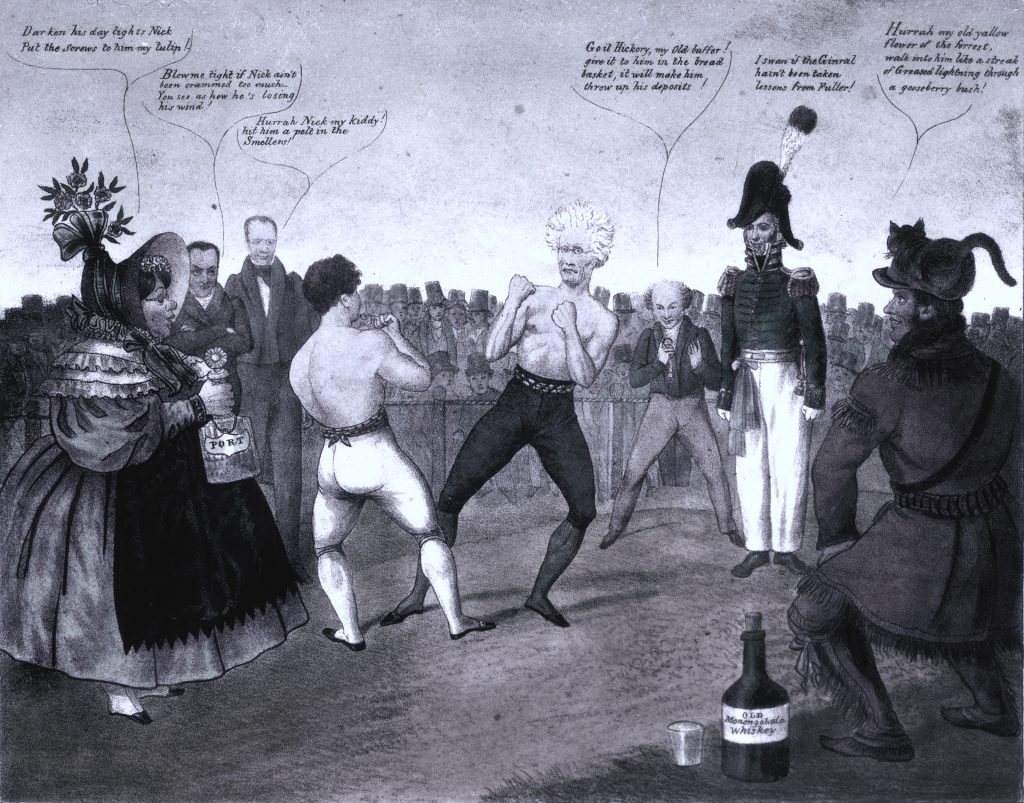

As the second national bank’s charter came up for renewal twenty years later, President Andrew Jackson was at war with the Bank’s president, Nicholas Biddle — charging the bank had failed to produce a stable national currency, and lacked constitutional legitimacy.

“Gentlemen! I too have been a close observer of the doings of the Bank of the United States. I have had men watching you for a long time, and am convinced that you have used the funds of the bank to speculate in the breadstuffs of the country. When you won, you divided the profits amongst you, and when you lost, you charged it to the bank. You tell me that if I take the deposits from the bank and annul its charter I shall ruin ten thousand families. That may be true, gentlemen, but that is your sin! Should I let you go on, you will ruin fifty thousand families, and that would be my sin! You are a den of vipers and thieves. I have determined to rout you out, and by the Eternal, I will rout you out!” ~ Andrew Jackson

Biddle forced an early vote on the Bank’s recharter while Jackson was running for re-election on an anti-bank platform. When Jackson vetoed the bill, Biddle poured bank money into an effort to defeat him. Jackson won re-election in a landslide and set out to destroy the bank by removing federal deposits. Biddle fought back, raising interest rates to deliberately cause a recession and force Jackson into a compromise.

“The ties of party allegiance can only be broken by the actual conviction of distress in the community. Nothing but the evidence of suffering abroad will produce any effect in Congress. I have no doubt that such a course will ultimately lead to restoration of the currency and the re-charter of the bank.” ~ Nicholas Biddle

Biddle’s effort backfired, and popular backlash forced him to abandon the fight. Congress voted to let the Bank’s charter expire.

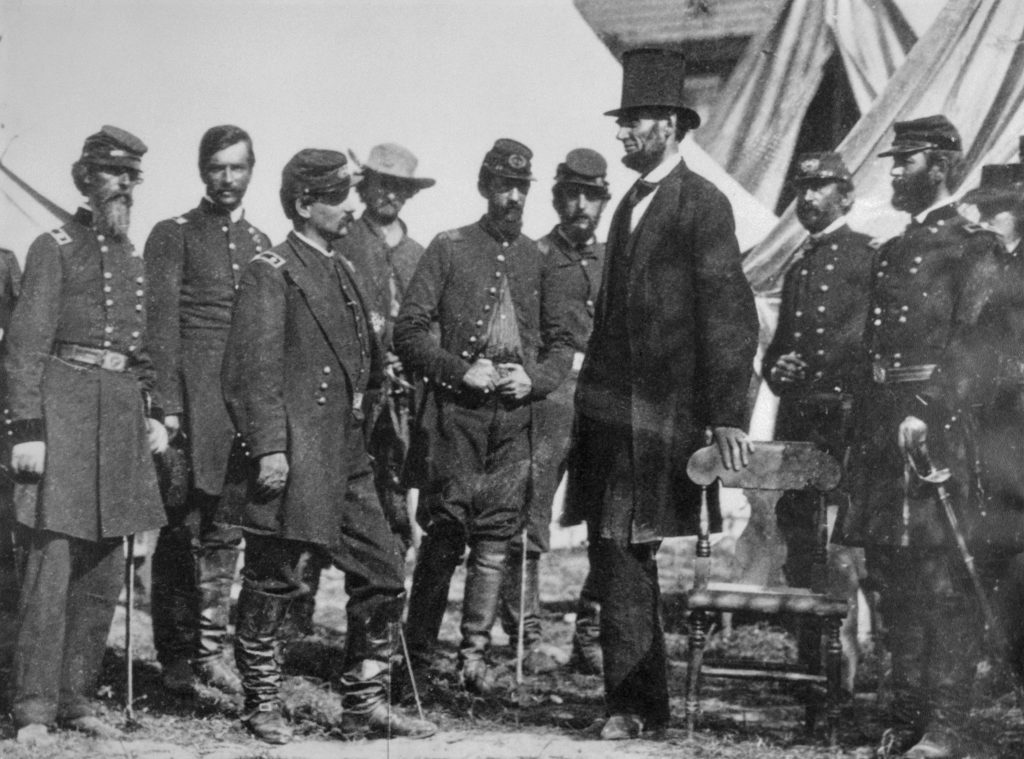

In the lead up to the Civil War, economic instability continued and there was rampant abuse in state banks with frequent bank failures. When Abraham Lincoln became President, he faced both a looming Civil War and a chaotic unregulated banking system that undermined the factory system and bogged down infrastructure development.

To finance the war, Eastern banks offered Lincoln an absurd loan package at usurious interest rates of 24-36%. Lincoln rejected the offer and printed non-interest bearing US Notes called Greenbacks that were used to pay soldiers and buy war supplies. As the war raged, Lincoln signed a National Banking Act into law in 1863 that attempted to establish a uniform banking system by creating a network of national banks and encouraging the development of a national currency.

After Lincoln’s assassination in 1865, international banking interests took the offensive. A law was passed in 1866 to curtail the Greenback and pave the way for the Gold Standard — but the actual effect was to reduce the money supply in circulation so there wasn’t enough to support the free trade of goods and services. Tightening of the money supply caused economic depression and unemployment. Bank runs were rampant where customers attempted to withdraw more currency than the bank held in reserve, forcing the bank into failure. Financial panics became the norm from 1873 to 1896 as a long depression set in with sustained price deflation and economic contraction.

In 1893, world events caused a major run on gold in the US Treasury. The money supply contracted sharply and unemployment rose to 25%. Farmers went bankrupt and lost their family farms. Bank runs dried up credit.

As the people suffered, the big issues remained unresolved — how to stabilize the money supply — and should control of the currency be in the hands of private citizens or the elected representatives of the people?

In episode 3, we’ll find out how a clandestine meeting between bankers and politicians on a Georgia coastal island decided the future of our monetary system.

You can learn more by reading Corey Wayne’s book, “Mastering Yourself” for FREE on his website UnderstandingRelationships.com by subscribing to the newsletter.

Get the Book “How To Be A 3% Man”

*Amazon and the Amazon logo are trademarks of Amazon.com, Inc. or its affiliates. As an Amazon Associate I earn from qualifying purchases. **Free with a new Audible.com membership

*Amazon and the Amazon logo are trademarks of Amazon.com, Inc. or its affiliates. As an Amazon Associate I earn from qualifying purchases.

How to Be a 3% Man

Paperback | $29.99

How to Be a 3% Man

Hardcover | $49.99

How to Be a 3% Man

Paperback | $29.99

How to Be a 3% Man

Hardcover | $49.99

*Amazon and the Amazon logo are trademarks of Amazon.com, Inc. or its affiliates. As an Amazon Associate I earn from qualifying purchases.

Get the Book “Mastering Yourself”

*Amazon and the Amazon logo are trademarks of Amazon.com, Inc. or its affiliates. As an Amazon Associate I earn from qualifying purchases. **Free with a new Audible.com membership

*Amazon and the Amazon logo are trademarks of Amazon.com, Inc. or its affiliates. As an Amazon Associate I earn from qualifying purchases.

Mastering Yourself

Paperback | $49.99

Mastering Yourself

Hardcover | $99.99

Mastering Yourself

Paperback | $49.99

Mastering Yourself

Hardcover | $99.99

*Amazon and the Amazon logo are trademarks of Amazon.com, Inc. or its affiliates. As an Amazon Associate I earn from qualifying purchases.

Get the Book “Quotes, Ruminations & Contemplations”

*Amazon and the Amazon logo are trademarks of Amazon.com, Inc. or its affiliates. As an Amazon Associate I earn from qualifying purchases. **Free with a new Audible.com membership

*Amazon and the Amazon logo are trademarks of Amazon.com, Inc. or its affiliates. As an Amazon Associate I earn from qualifying purchases.

Quotes, Ruminations & Contemplations

Paperback | $49.99

Quotes, Ruminations & Contemplations

Hardcover | $99.99

*Amazon and the Amazon logo are trademarks of Amazon.com, Inc. or its affiliates. As an Amazon Associate I earn from qualifying purchases.

If you have a question you would like me to consider answering in a future Video Coaching Newsletter, you can send it (3-4 paragraphs/500 words max) to this email address: [email protected]

If you feel I have added value to your life, you can show your appreciation by doing one of the following three things:

- Make a donation to my work by clicking here to donate via PayPal anytime you feel I have added significant value to your life. You tip your favorite bartender, right? How about a buck... $2... $3... $5... $10... $20... what ever YOU feel its worth, every time you feel I have given you a good tip, new knowledge or helpful insight. Please feel free to donate any amount you think is equal to the value you received from my eBook & Home Study Course (audio lessons), articles, videos, emails, newsletters, etc.

- Referring your friends and family to this website so they can start learning and improving their dating and relationship life, happiness, balance and overall success in every area of their lives too!

- Purchase a phone/Zoom (audio only) coaching session for yourself or a friend by clicking here. Download the Amazon.com Kindle version of my book to your Kindle, Smartphone, Mac or PC for only $9.99 by clicking here. Get the iBook version for $9.99 from the iBookstore by clicking here. Get the Audio Book for FREE $0.00 with an Audible.com membership by clicking here or buy it for $19.95 at Amazon.com by clicking here. Get the iTunes Audio Book for $19.95 by clicking here. That way, you'll always have it with you to reference when you need it most. Thank you for reading this message!

From my heart to yours,

Corey Wayne

Author, Speaker, Peak Performance Coach, Entrepreneur

Click Anywhere on Today’s Instagram Image Below & You’ll Be Taken To My Instagram Page. When you get to my Instagram page, click the “Follow” Button so you can follow me on Instagram. I upload several new Instagram photos per week.

Leave A Reply