In Episode 3 – “Economic Boom/Bust Cycles” of this 4 part documentary on the monetary system, “Power To The People,” we discuss private banks hoarding gold and shrinking the money supply, Democratic presidential candidate, William Jennings Bryan, and his efforts to use gold and silver to back the US currency to increase the money supply, and early government infrastructure plans using government issued bonds.

We also discuss the origins of “The Wonderful Wizard of Oz” as a parable about the gold and silver political debate at the turn of the 19th century, the Federal Reserve Act of 1913, the stock market crash of 1929, the great depression, WWII’s effect on the money supply and the economic recovery it facilitated, and the Bretton Woods monetary system after World War 2, making the US Dollar the world’s reserve currency. Additionally, Nixon taking the US off of the gold standard in 1971, US government debt skyrocketing, the purpose of the Federal Reserve banking system, the cause of the boom and bust economic cycle, how the boom and bust cycle fuels arguments for socialism and against capitalism, the sub-prime mortgage crisis, and the great recession.

At the end of the 1800s, a national debate raged as to whether the money supply could be stabilized by pegging the currency to the value of gold. The problem was private banks held most of the gold and could manipulate prices, causing gold to be withdrawn from the market and hoarded which shrank the money supply.

A populist democrat, William Jennings Bryan was running against incumbent President William McKinley. Bryan advocated a solution — to use gold and silver to back the currency and immediately increase the money supply. A brilliant orator, Bryan gave his famous “Cross of Gold” speech at the 1896 Democratic presidential convention — arguing in opposition to the gold standard that “you shall not crucify mankind on a cross of gold.”

At the time, an Ohio businessman named Jacob Coxey led a popular protest march on Washington to demand Congress pass an infrastructure plan financed by $500 million dollars in currency backed by government bonds. Author, L. Frank Baum, witnessed the march and drew inspiration for his book “The Wonderful Wizard of Oz” — a parable of the money debate at the time.

In the book, Dorothy represented the American people — her slippers were silver, and symbolized Bryan’s silver solution to the money crisis — the wicked witches of the West and East represented President McKinley and the wall street bankers — the cowardly lion was Bryan who had a mighty roar but no political power — the scarecrow symbolized farmers ignorant of government financial policies — the tin man, factory workers frozen by unemployment — the yellow brick road was an illusion of the stability of the gold standard — Oz was the American dream unrealized — and the Wizard of Oz was the American president whose strings were being pulled behind the curtains by bankers.

“The people had been deluded into a belief in scarcity by defining their wealth in terms of a scarce commodity, gold. The country’s true wealth consisted of its goods and services, its resources and the creativity of its people.” ~ Ellen Brown, The Web of Debt

Bryan ended up losing the election, and the Gold standard was established in 1900 — but stabilizing the money supply remained elusive. After a financial panic in 1907, the stock market fell 50%. There was broad agreement to create a central banking system that could provide a more elastic currency and coordinate responses to financial panics.

To solve the problem, Nelson Aldrich — a powerful Republican senator and Chairman of the National Monetary Commission — convened a secret meeting on Jekyll Island, Georgia in 1910. In attendance were representatives of 1/4th of the world’s wealth — the John D. Rockefeller and JP Morgan banking consortiums — the Rothschild banking group of England and France — and the Warburg group from Germany and the Netherlands. The most powerful bankers in the world devised a legislative plan to create a central banking cartel and hide its true nature behind smoke and mirrors.

President Woodrow Wilson sought a middle ground between progressives such as Bryan — and Aldrich, who put forward the plan conceived at Jekyll Island, that gave private financial interests a large degree of control over the monetary system.

Wilson declared the banking system must be “public not private, [and] must be vested in the government itself so that the banks must be the instruments, not the masters, of business.”

Democratic Congressmen crafted a compromise in which private banks would control twelve regional Federal Reserve Banks, overseen by a central board filled with presidential appointees.

The Federal Reserve Act of 1913 passed after Wilson convinced Bryan’s supporters that the plan met their demands for an elastic currency because Federal Reserve notes would be government obligations. It enshrined a gold standard by fixing the price of gold and requiring the Fed to hold gold reserves equal to 40% of the value of currency it issued.

But the Federal Reserve was not what most people thought. It was not a federal bank. It was a collection of 12 private banks who now had virtual monopoly power to issue US dollars. Wilson would end up deeply regretting the bill.

“A great industrial nation is controlled by its system of credit. Our system of credit is privately concentrated. The growth of the nation, therefore, and all our activities are in the hands of a few men … We have come to be one of the worst ruled, one of the most completely controlled and dominated, governments in the civilized world—no longer a government by free opinion, no longer a government by conviction and the vote of the majority, but a government by the opinion and the duress of small groups of dominant men.” ~ Woodrow Wilson

Wilson’s fears were well-founded. Throughout the 1920s, the Fed recklessly increased the money supply by creating ever more debt and issuing easy credit. Middle-class Americans flooded into the stock market, buying up stocks on credit and fueling a market bubble.

When the stock market crashed in 1929, the money supply sharply contracted — shutting down commerce and plunging the world into the Great Depression. Gold was hoarded, and the Fed raised interest rates, making the Depression worse and forcing companies into bankruptcy.

“The elementary truth is that the Great Depression was produced by government mismanagement. It was not produced by the failure of private enterprise, it was produced by the failure of government to perform a function which had been assigned to it.” ~ Milton Friedman

By 1932, the Fed couldn’t increase the money supply because it was near the limit of currency that could be backed by the gold in its possession. The country was in deep trouble when Franklin Roosevelt was elected President on a promise to take government action to end the Great Depression.

When a run on gold reserves in 1933 threatened to bankrupt the country, Roosevelt took drastic action — closing all banks until they relinquished their gold to the Federal Reserve. Americans were ordered by law to turn their gold in for dollars. The intent was to remove the constraint on the Fed that was keeping it from increasing the money supply. President Roosevelt also came down hard on Wall Street and passed a new deal to stimulate the economy. But instead of printing interest-free money like Lincoln had with Greenbacks, he borrowed it at interest.

“The real truth of the matter is as you and I know, that a financial element in the larger centers has owned the government ever since the days of Andrew Jackson…” ~ Franklin D. Roosevelt

Despite Roosevelt’s efforts, the depression dragged on. It was only the widespread economic mobilization required by World War II that led to full employment and finally put an end to the depression.

To finance the production of weapons and war supplies for the Allied armies, the government borrowed money by printing war bonds and enlisting Hollywood celebrities to sell them to the public for cash. This resulted in a significant increase in the money supply in circulation and led to full employment.

As World War II neared its conclusion, the scale of destruction was enormous. The Allies realized the world would need a new financial system to facilitate global reconstruction.

In 1944, 44 nations met in Bretton Woods, New Hampshire and agreed to set the US dollar as the world’s reserve currency — backed by gold — since the U.S. held most of the world’s gold supply.

The new system remained in effect until 1971 when the US gold supply was no longer adequate to cover the total number of dollars in circulation. President Richard Nixon rendered Bretton Woods inoperative by suspending the convertibility of the dollar into Gold. From now on, currency exchange rates would float freely and not be tied to the value of gold. This removed the only effective check on the Fed’s ability to expand the money supply exponentially as it wished, and freed up the politicians to spend without limit by issuing government debt.

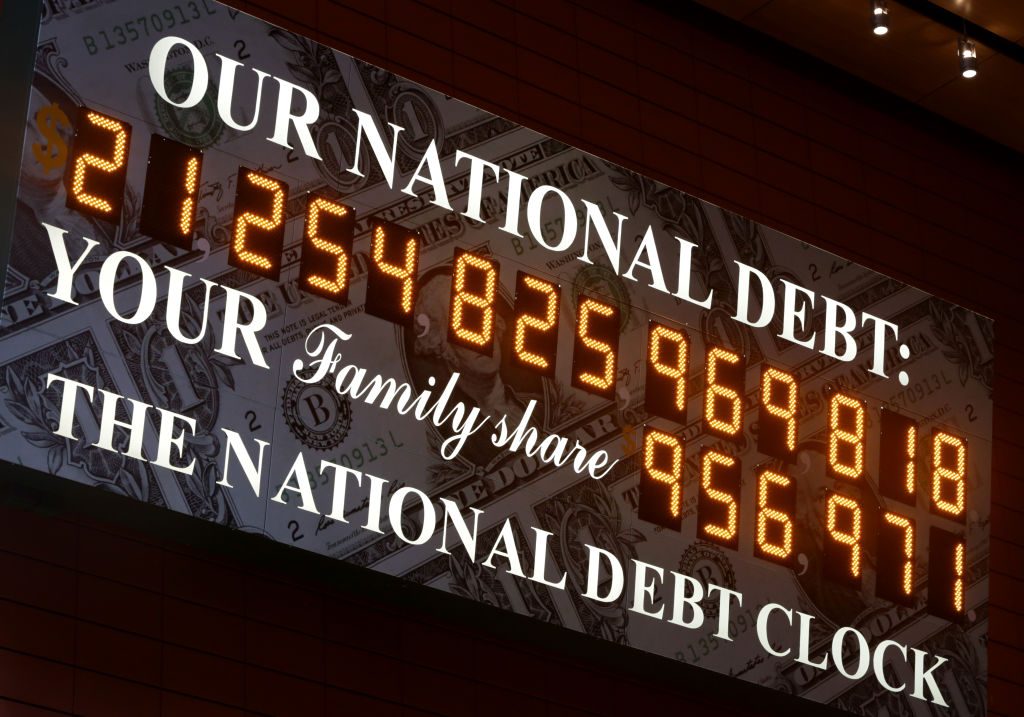

The ugly truth is that since 1971, boom/bust cycles have continued while US Government debt has steadily increased from $400 billion dollars in 1971 to over $22 trillion dollars today. Taxpayers are paying more and more interest on a ballooning national debt as bankers create ever more money from nothing and loan it out at interest.

The Fed is supposed to keep the money supply and economy stable and help achieve full employment by adjusting short term interest rates and bank deposit reserve requirements as needed to cool down or heat up the economy. When interest rates or reserve requirements are increased, the money supply contracts and asset prices go down because fewer people have the money to buy them. When interest rates or reserve requirements are lowered, the money supply expands and asset prices go up because people have more money to buy them. If the Fed does this in an uneven way, the economy suffers boom and bust cycles that excessively inflate and deflate asset prices. This is what creates the temptation for bankers to manipulate markets by artificially creating boom/bust cycles that enable the wealthy to buy up assets at deflated prices.

“Buy when there’s blood in the streets, even if the blood is your own.” ~ attributed to Baron Rothschild

The biggest boom/bust of all began in 2007 when a housing bubble burst and the subprime mortgage market crashed.

This time, politicians had manipulated real estate lending to expand home ownership, fostering a subprime mortgage market by giving government guarantees for FHA, VA, Fannie Mae, and Freddie Mac loans, and pressuring the lending industry to make mortgage loans to people with bad credit. The result was an unprecedented housing boom with rampant mortgage fraud, predatory lending and hyper-inflated home values. Wall Street compounded the problem by bundling subprime loans and selling them as derivative securities backed by credit default insurance to the tune of some $60 trillion dollars.

When the Fed started raising interest rates too fast, people could no longer afford their monthly mortgage payments, because most subprime mortgages had adjustable interest rates that closely tracked the Fed’s prime rate and the LIBOR or London Inter-bank Offered rate. Interest rates weren’t fixed but could be adjusted by the lender on a monthly, quarterly, bi-annual or annual basis. As interest rates rose, more and more people went into default, because they couldn’t afford the higher monthly payments. The Fed was caught flat-footed, claiming they were unaware just how massive the subprime mortgage derivative market had become. The whole house of cards came crashing down, causing a global recession.

To prevent a complete meltdown, the US Government injected at least $1.9 trillion dollars into the banking system through the Fed and bailed out banks and companies considered too big to fail. The total commitment to bank bailouts is believed to exceed $16 trillion dollars. The Great Recession is estimated to have cost every American a minimum of $70,000 — or $24.5 trillion dollars in total. Whatever the true cost, the American people will be paying it for a long time to come.

“Is there any reason why the American people should be taxed to guarantee the debts of banks, any more than they should be taxed to guarantee the debts of other institutions, including merchants, the industries, and the mills of the country?” ~ Senator Carter Glass, Author of the Glass-Steagall Banking Act of 1933

Despite everything that’s been tried, creating a stable and elastic money supply has remained one of our greatest challenges.

In Episode 4, we’ll consider a number of financial adjustments that could curb the excesses of the politicians and bankers and help solve our collective economic problems.

You can learn more by reading Corey Wayne’s book, “Mastering Yourself” for FREE on his website UnderstandingRelationships.com by subscribing to the newsletter.

Get the Book “How To Be A 3% Man”

*Amazon and the Amazon logo are trademarks of Amazon.com, Inc. or its affiliates. As an Amazon Associate I earn from qualifying purchases. **Free with a new Audible.com membership

*Amazon and the Amazon logo are trademarks of Amazon.com, Inc. or its affiliates. As an Amazon Associate I earn from qualifying purchases.

How to Be a 3% Man

Paperback | $29.99

How to Be a 3% Man

Hardcover | $49.99

How to Be a 3% Man

Paperback | $29.99

How to Be a 3% Man

Hardcover | $49.99

*Amazon and the Amazon logo are trademarks of Amazon.com, Inc. or its affiliates. As an Amazon Associate I earn from qualifying purchases.

Get the Book “Mastering Yourself”

*Amazon and the Amazon logo are trademarks of Amazon.com, Inc. or its affiliates. As an Amazon Associate I earn from qualifying purchases. **Free with a new Audible.com membership

*Amazon and the Amazon logo are trademarks of Amazon.com, Inc. or its affiliates. As an Amazon Associate I earn from qualifying purchases.

Mastering Yourself

Paperback | $49.99

Mastering Yourself

Hardcover | $99.99

Mastering Yourself

Paperback | $49.99

Mastering Yourself

Hardcover | $99.99

*Amazon and the Amazon logo are trademarks of Amazon.com, Inc. or its affiliates. As an Amazon Associate I earn from qualifying purchases.

Get the Book “Quotes, Ruminations & Contemplations”

*Amazon and the Amazon logo are trademarks of Amazon.com, Inc. or its affiliates. As an Amazon Associate I earn from qualifying purchases. **Free with a new Audible.com membership

*Amazon and the Amazon logo are trademarks of Amazon.com, Inc. or its affiliates. As an Amazon Associate I earn from qualifying purchases.

Quotes, Ruminations & Contemplations

Paperback | $49.99

Quotes, Ruminations & Contemplations

Hardcover | $99.99

*Amazon and the Amazon logo are trademarks of Amazon.com, Inc. or its affiliates. As an Amazon Associate I earn from qualifying purchases.

If you have a question you would like me to consider answering in a future Video Coaching Newsletter, you can send it (3-4 paragraphs/500 words max) to this email address: [email protected]

If you feel I have added value to your life, you can show your appreciation by doing one of the following three things:

- Make a donation to my work by clicking here to donate via PayPal anytime you feel I have added significant value to your life. You tip your favorite bartender, right? How about a buck... $2... $3... $5... $10... $20... what ever YOU feel its worth, every time you feel I have given you a good tip, new knowledge or helpful insight. Please feel free to donate any amount you think is equal to the value you received from my eBook & Home Study Course (audio lessons), articles, videos, emails, newsletters, etc.

- Referring your friends and family to this website so they can start learning and improving their dating and relationship life, happiness, balance and overall success in every area of their lives too!

- Purchase a phone/Zoom (audio only) coaching session for yourself or a friend by clicking here. Download the Amazon.com Kindle version of my book to your Kindle, Smartphone, Mac or PC for only $9.99 by clicking here. Get the iBook version for $9.99 from the iBookstore by clicking here. Get the Audio Book for FREE $0.00 with an Audible.com membership by clicking here or buy it for $19.95 at Amazon.com by clicking here. Get the iTunes Audio Book for $19.95 by clicking here. That way, you'll always have it with you to reference when you need it most. Thank you for reading this message!

From my heart to yours,

Corey Wayne

Author, Speaker, Peak Performance Coach, Entrepreneur

Click Anywhere on Today’s Instagram Image Below & You’ll Be Taken To My Instagram Page. When you get to my Instagram page, click the “Follow” Button so you can follow me on Instagram. I upload several new Instagram photos per week.

Leave A Reply