In Episode 4 – “Achieving Economic Prosperity” of this 4 part documentary on the monetary system, “Power To The People,” we discuss some possible solutions to stabilize the monetary system, the economy, dealing with the ballooning national debt, eliminating the arguments for socialism and against capitalism, and how to create economic prosperity and stability for everyone.

Since the Great Recession, markets have largely recovered, but the flaws in the monetary system remain. Family income has dropped and the wealth gap has widened, while the national debt has spiked from $9 trillion dollars in 2007 to $22 trillion today, further eroding the dollar’s value. Interest costs on the national debt are $389 billion dollars in 2019. The Congressional Budget Office projects an increase to $914 billion by 2028. The ugly truth is the politicians and bankers are drowning us in debt and the American people are on the hook to pay for it.

“Lenin is said to have declared that the best way to destroy the Capitalistic System was to debauch the currency… Lenin was certainly right. There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million can diagnose.” ~ John Maynard Keynes

Given the Fed’s history, people on the left and right feel the system is rigged to make the rich richer and poor poorer. There’s no question some big banks and large transnational corporations have been protected from the consequences of risky business practices and their losses passed on to the U.S. taxpayer. The bottom line is the Fed has failed in its most important function — to maintain stability in the economy and a stable money supply.

We can think of the national economy as a giant swimming pool with the water representing money that streams in from several faucets, and flows out through several drains. The goal of monetary policy is to maintain a stable water level in the pool. When new money is created — such as when the US Government borrows money — or American consumers and corporations borrow money to buy homes, office buildings, cars and boats, or to make credit card purchases — or when foreign corporations open offices or build factories in the U.S — or foreign investors buy homes or stock in American companies — or when American companies return to the US to take advantage of lower taxes — it’s like turning on the tap to let more water in.

But water runs out when loans are paid off — when illegal and legal workers send money to relatives in their home countries — when companies fire their employees and move their cash and operations overseas — when we run trade deficits that send cash permanently out of our economy to circulate in foreign economies in exchange for their products — when the US government spends money on foreign aid — or when we buy oil or other commodities from foreign countries.

The Fed is supposed to oversee the velocity of cash flow to the faucets, priming the pump with interest rate or reserve adjustments when the water level drops, rises or becomes unstable. It works in theory until there’s a huge spike in money leaving the pool, which has the effect of stranding people on the shore, because there isn’t enough money for them to float in the economic pool. This is what happened in 2007 when the market collapse drained some $3 trillion dollars from the money supply almost overnight and caused the Great Recession.

Fixing the problem will require finding better tools to stabilize the money supply — adding new faucets that can quickly inject money into the economy in times of market and economic turmoil. And it requires ending the temptations that enable bankers and politicians to make bad monetary and economic decisions and pass the bill on to the taxpayers.

“He who introduces a new order of things has all those who profit from the old order as his enemies, and he has only lukewarm allies in all those who might profit from the new.” ~ Niccolo Machiavelli

Modifying the monetary system won’t be easy, but there are several things we should all be able to agree on. No bank or corporation should be bailed out by taxpayers for making bad business decisions. Bankers shouldn’t have the exclusive right to create the nation’s money supply from nothing and lend it out at interest. And politicians shouldn’t be able to run up massive government debts and burden future generations with higher taxes to pay the interest.

If we are to truly have free markets that serve the interests of the people, bankers simply can’t have unchecked control of the tools to manipulate them. And while government has a clear role in overseeing the economy, the Fed needs to remain mostly independent, as too much power in the hands of politicians invariably leads to disaster.

Socialist politicians consistently destroy the value of their currency by asserting too much government control. This is what happened when oil-rich Venezuela elected socialist leader, Hugo Chavez. He promised the poor everything, while demonizing capitalism and the rich and seizing private property. Money fled the country, and the supply of cash circulating in the economic pool emptied out. Foreign banks no longer accepted Venezuelan currency, and foreign investors no longer wanted to invest in Venezuela because the government might confiscate their companies and assets for pennies on the dollar. The government printed excessive digital and paper money to try to make up the shortfall, rendering the Venezuelan currency worthless. The result is the financial and humanitarian disaster we see today.

To make our monetary system truly responsive to the needs of the people, we should learn from the past and use new technologies to make us smarter. Artificial Intelligence might be tasked to analyze the country’s financial history and our current monetary system and recommend the optimal monetary cashflows to improve and permanently stabilize it — eliminating the destructive boom and bust cycles once and for all.

We could pull back the curtain and rename the national debt what it really is — the “US Treasury created money supply.” We should find ways to phase out interest-bearing national debt, replacing it with extremely low or zero percent interest bearing loans on infrastructure projects — and we should supplement the system with additional money injection faucets to keep a stable level of money in the economic pool.

Additional faucets might include creating a Universal Basic Income (UBI) faucet from the US Treasury — developing State Bank faucets to meet infrastructure needs — and creating 38 additional Federal Reserve banks to be based in each state that are closer in proximity to their communities and can be more responsive to the monetary cash-flow needs of local economies. These additional faucets could help stabilize the money supply in circulation at the federal, state and local level.

Ellen Brown, President of the Public Banking Institute and author of “The Web of Debt,” believes infrastructure needs could best be met by establishing public development banks at the state level to lend money out for approved infrastructure projects.

“The main flaw in the current model is that private profiteers have acquired control of the money spigots. They can cut off the flow, direct it to their cronies, and manipulate it for personal gain at the expense of the producing economy. The benefits of bank credit can be maintained while eliminating these flaws, through a system of banks operated as public utilities, serving the public interest and returning their profits to the public.” ~ Ellen Brown

The public bank of North Dakota is a good example. State revenues are deposited in the public bank instead of private banks, and it provides low interest loans to pay for the state’s needs. Even during the Great Recession, the unemployment rate in North Dakota remained steady because the bank was able to stabilize the money supply circulating in the state and local economies.

In 2002, future Fed Chairman Ben Bernanke floated the idea of “helicopter money” that could be broadly spread across the economy to increase the money supply in times of contraction. He suggested “Congress might create a special Treasury account at the Fed, and give the Fed sole authority to fill the account up to some prespecified level. Funds would be added to the account only if the Fed decided a “helicopter drop” of a specified amount to the national money supply was needed to achieve the Fed’s employment and inflation goals.” This would act like an additional faucet that could enable the Fed to inject money directly into the system in specific locations and widely distribute funds to the public in times of market contraction, without risking too much coordination between Congress and the central bank.

Another idea gaining traction is Universal Basic Income or UBI, in which every citizen, whether employed or not, would receive a fixed periodic sum of money from the government with no strings attached.

With Artificial Intelligence and automation expected to make 75 million American jobs redundant by the year 2025, UBI deserves a serious look. The rationale is, if banks create money out of thin air for private loans and government spending, why not do the same to create basic economic stability for everyone?

It’s possible welfare and government benefits could be replaced with a UBI, so the money supply is more stable and the economy less vulnerable to boom/bust cycles. This would give people a secure financial base to cover the basic needs of life and free them up to be more productive by doing work they love and enjoy. Instead of struggling to put food on the table and a roof over their head, people could be empowered to pursue their passions and contribute to the world in unique and creative ways.

The bottom line is the monetary system needs to be enhanced to help people protect and improve their store of personal financial value and provide a stable cash flow for their life’s work. Since people get paid based on the value they bring to the marketplace, getting paid more is the result of developing their gifts, skills and talents and growing their reserve of knowledge. It’s human nature that people will work harder at things they love and enjoy. With a stable and elastic money supply, people willing to work for it can be freed to reach their full and highest potential. This is why enhancing the monetary system should be a top priority — because it’s central to individual liberty and the pursuit of happiness — and the key to creating a more prosperous and equitable society for all.

In the meantime, if people worry about the value of the dollar and being vulnerable to mismanagement of the money supply by the bankers and politicians, they can move part of their store of financial value outside the banking system and into alternatives such as cryptocurrencies based on blockchain — foreign currencies — and physical assets like precious metals, art and real estate. Having a portion of value stored in alternative vehicles serves as a hedge that can help insulate us from the worst effects of money instability and bad monetary policy.

Blockchain in particular is largely independent of the monetary and banking systems and immunized from currency volatility. The more widely accepted it becomes, the more people might seek refuge in cryptocurrencies that aren’t as vulnerable to the steady erosion of the dollar’s value caused by government deficit spending. It’s a separate spigot individuals could tap into to stay afloat when the economy gets turbulent and unstable.

While there are no silver bullets, adding new money faucets to the national economy could help keep the water level in the pool of cash more stable and make the money supply more elastic to meet our collective financial needs.

By limiting the ability of banks and large corporations to be bailed out at taxpayer expense and stopping politicians from spending recklessly and depreciating the value of our currency, we might finally bring an end to long-standing complaints against both capitalism and government.

In the big picture, we might be able to solve all kinds of societal problems and narrow the gaps between rich and poor — and left and right. And most importantly, the American promise of individual liberty and prosperity can be restored for all the people.

“Money might indeed become a servant of humanity, transformed from a tool of oppression into a means of securing common prosperity. But first, the central bank needs to become a public servant. It needs to be made a public utility, responsive to the needs of the people and the economy.” ~ Ellen Brown

You can learn more by reading Corey Wayne’s book, “Mastering Yourself” for FREE on his website UnderstandingRelationships.com by subscribing to the newsletter.

Get the Book “How To Be A 3% Man”

*Amazon and the Amazon logo are trademarks of Amazon.com, Inc. or its affiliates. As an Amazon Associate I earn from qualifying purchases. **Free with a new Audible.com membership

*Amazon and the Amazon logo are trademarks of Amazon.com, Inc. or its affiliates. As an Amazon Associate I earn from qualifying purchases.

How to Be a 3% Man

Paperback | $29.99

How to Be a 3% Man

Hardcover | $49.99

How to Be a 3% Man

Paperback | $29.99

How to Be a 3% Man

Hardcover | $49.99

*Amazon and the Amazon logo are trademarks of Amazon.com, Inc. or its affiliates. As an Amazon Associate I earn from qualifying purchases.

Get the Book “Mastering Yourself”

*Amazon and the Amazon logo are trademarks of Amazon.com, Inc. or its affiliates. As an Amazon Associate I earn from qualifying purchases. **Free with a new Audible.com membership

*Amazon and the Amazon logo are trademarks of Amazon.com, Inc. or its affiliates. As an Amazon Associate I earn from qualifying purchases.

Mastering Yourself

Paperback | $49.99

Mastering Yourself

Hardcover | $99.99

Mastering Yourself

Paperback | $49.99

Mastering Yourself

Hardcover | $99.99

*Amazon and the Amazon logo are trademarks of Amazon.com, Inc. or its affiliates. As an Amazon Associate I earn from qualifying purchases.

Get the Book “Quotes, Ruminations & Contemplations”

*Amazon and the Amazon logo are trademarks of Amazon.com, Inc. or its affiliates. As an Amazon Associate I earn from qualifying purchases. **Free with a new Audible.com membership

*Amazon and the Amazon logo are trademarks of Amazon.com, Inc. or its affiliates. As an Amazon Associate I earn from qualifying purchases.

Quotes, Ruminations & Contemplations

Paperback | $49.99

Quotes, Ruminations & Contemplations

Hardcover | $99.99

*Amazon and the Amazon logo are trademarks of Amazon.com, Inc. or its affiliates. As an Amazon Associate I earn from qualifying purchases.

If you have a question you would like me to consider answering in a future Video Coaching Newsletter, you can send it (3-4 paragraphs/500 words max) to this email address: [email protected]

If you feel I have added value to your life, you can show your appreciation by doing one of the following three things:

- Make a donation to my work by clicking here to donate via PayPal anytime you feel I have added significant value to your life. You tip your favorite bartender, right? How about a buck... $2... $3... $5... $10... $20... what ever YOU feel its worth, every time you feel I have given you a good tip, new knowledge or helpful insight. Please feel free to donate any amount you think is equal to the value you received from my eBook & Home Study Course (audio lessons), articles, videos, emails, newsletters, etc.

- Referring your friends and family to this website so they can start learning and improving their dating and relationship life, happiness, balance and overall success in every area of their lives too!

- Purchase a phone/Zoom (audio only) coaching session for yourself or a friend by clicking here. Download the Amazon.com Kindle version of my book to your Kindle, Smartphone, Mac or PC for only $9.99 by clicking here. Get the iBook version for $9.99 from the iBookstore by clicking here. Get the Audio Book for FREE $0.00 with an Audible.com membership by clicking here or buy it for $19.95 at Amazon.com by clicking here. Get the iTunes Audio Book for $19.95 by clicking here. That way, you'll always have it with you to reference when you need it most. Thank you for reading this message!

From my heart to yours,

Corey Wayne

Author, Speaker, Peak Performance Coach, Entrepreneur

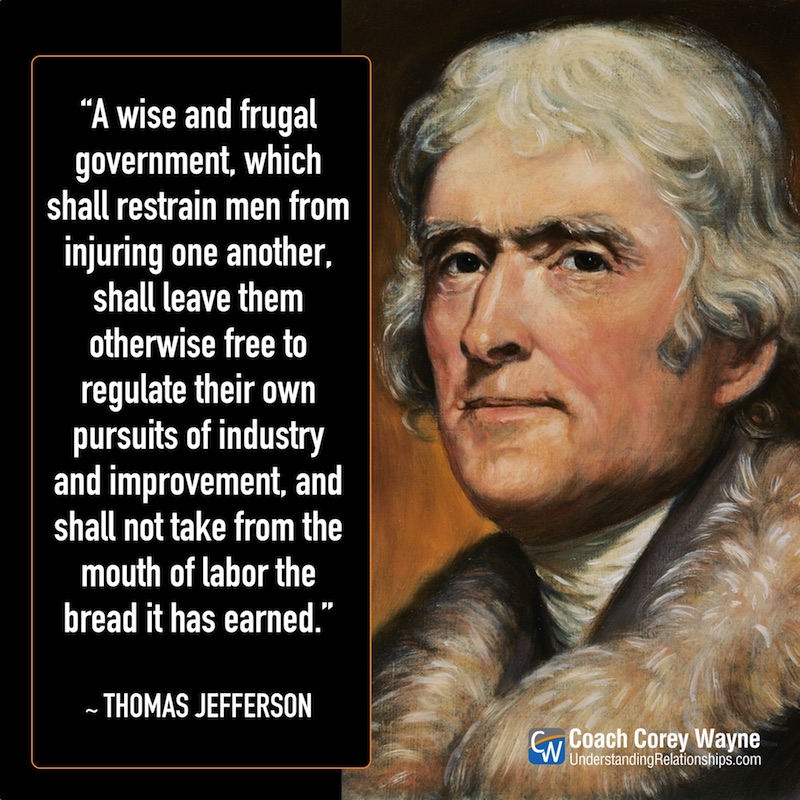

Click Anywhere on Today’s Instagram Image Below & You’ll Be Taken To My Instagram Page. When you get to my Instagram page, click the “Follow” Button so you can follow me on Instagram. I upload several new Instagram photos per week.

Leave A Reply